Bitcoin 4-Year Cycle Explained for Beginners: Halvings, Bull Runs, Bear Markets, and Altcoins

- 21 Dec 2025

I don’t know if anyone has ever told you this but Bitcoin’s price doesn’t move randomly it’s influenced by predictable patterns tied to its core mechanics. The “Bitcoin 4-year cycle” refers to the recurring bull and bear markets roughly every four years, primarily driven by the halving event. For beginners, understanding this cycle is crucial for managing expectations, avoiding panic sells, and timing entries wisely.

In this guide, I’ll break down the halving mechanism, the typical cycle structure (including the 1066-day bull runs from bear bottoms and 400-day declines from bull tops), historical price evolution from Bitcoin’s inception in 2009 to late 2025, and how altcoins often amplify or lag these patterns. This knowledge builds on fundamentals from What is Cryptocurrency? A Complete Beginner’s Guide to Blockchain in 2026 and helps prevent the 10 Biggest Crypto Mistakes Beginners Make in 2026, like buying at peaks due to FOMO.

By mastering these cycles, you’ll align with strategies like Dollar Cost Averaging Explained: The Best Strategy for Crypto Beginners in 2026 and develop the mindset from Crypto Investing Psychology: Mastering Emotions and Avoiding FOMO as a Beginner in 2026. This article serves as an advanced entry in our getting-started pillar, bridging to trading and investing topics.

What Is the Bitcoin Halving and Why Does It Matter?

The Bitcoin halving is a programmed event every 210,000 blocks (roughly every four years) where the mining reward for new blocks is cut in half. This reduces the rate of new Bitcoin entering circulation, creating a supply shock.

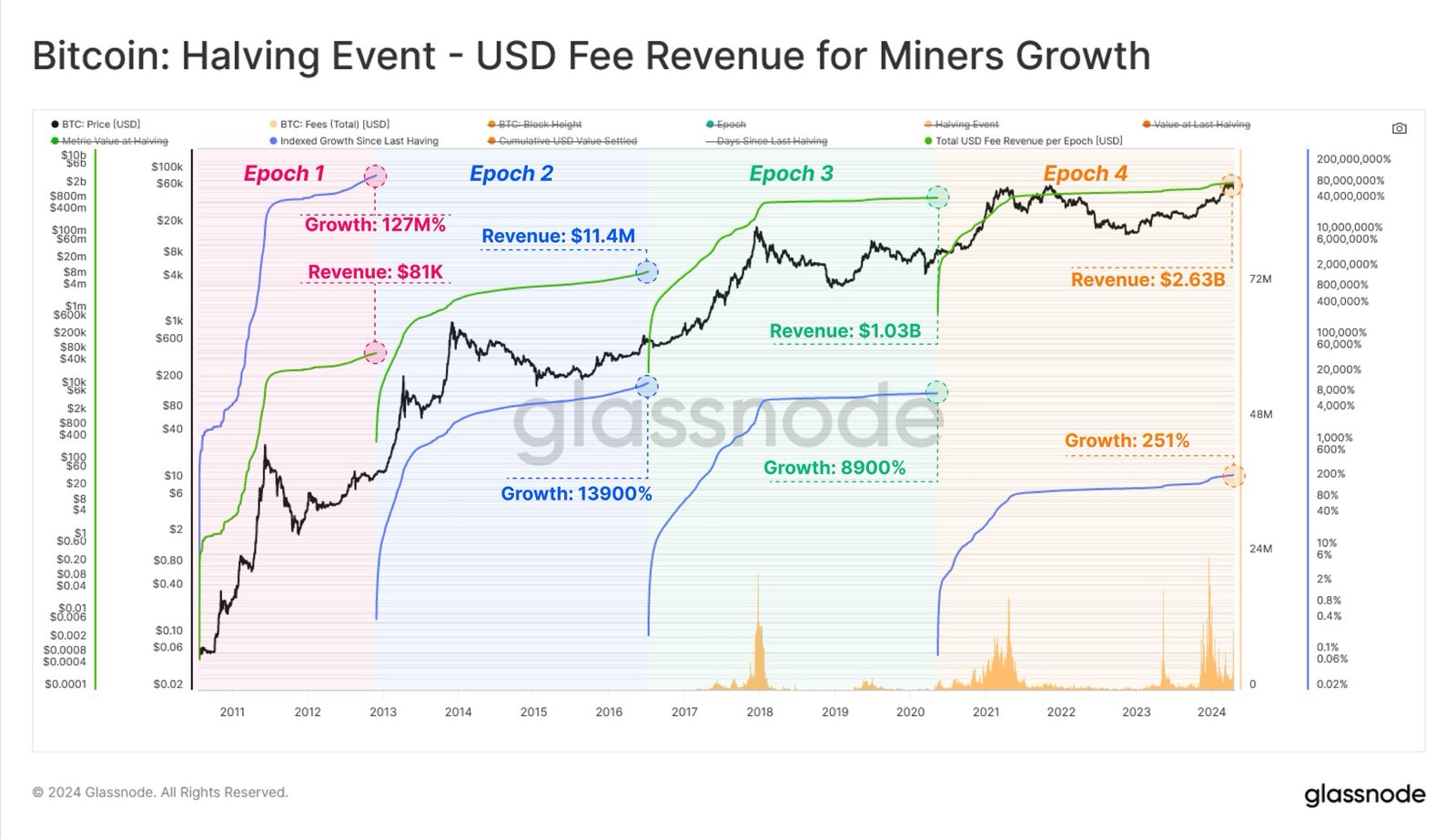

- How It Works: Bitcoin’s total supply is capped at 21 million. Miners receive rewards for validating transactions—starting at 50 BTC per block in 2009, halving to 25 in 2012, 12.5 in 2016, 6.25 in 2020, 3.125 in 2024, and so on until around 2140.

- Economic Impact: With demand steady or growing, reduced supply often drives prices up over time. Halvings act as catalysts for bull markets.

Halvings aren’t just technical—they fuel market psychology, sparking speculation and investment inflows.

The Structure of Bitcoin’s 4-Year Cycle

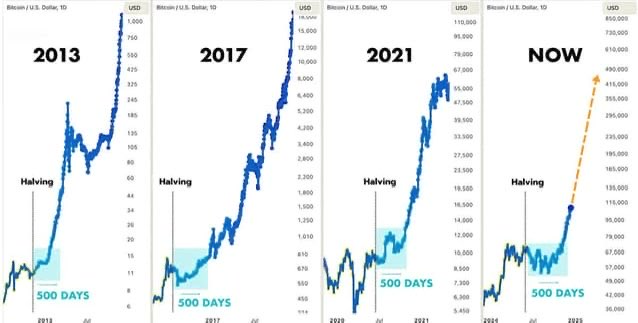

Bitcoin’s price history shows repeating cycles aligned with halvings:

- Bear Market Bottom: After a bull peak, prices crash and consolidate for months, forming a “bottom.”

- Pre-Halving Rally: Anticipation builds, leading to gradual climbs.

- Post-Halving Bull Run: Explosive growth as supply tightens and adoption surges.

- Bull Market Top: Euphoria peaks, followed by a sharp correction into the next bear.

Historical data reveals patterns:

- Bull Phase: From bear bottom to bull top, Bitcoin often rises for about 1066 days (roughly 3 years).

- Bear Phase: From bull top to next bottom, it declines over approximately 400 days (about 13 months).

These aren’t exact—variations occur due to external factors like regulations, macroeconomics, or events (e.g., 2022’s FTX collapse). But the cycle has held across four halvings.

Historical Bitcoin Price Cycles: From 2009 to 2025

Bitcoin started at $0 in 2009. Here’s a cycle-by-cycle breakdown with approximate prices (log-scale charts show percentage gains clearly).

Cycle 1: 2009-2013 (First Halving: November 2012)

- Bear Bottom: Early 2011 (~$1 after initial hype fade).

- Bull Run: 1066 days to peak at ~$1,150 in late 2013 (post-halving surge).

- Bear Decline: 410 days down to ~$200 in early 2015.

- Key Events: Pizza Day (2010), first exchanges.

Cycle 2: 2013-2017 (Second Halving: July 2016)

- Bear Bottom: January 2015 (~$200).

- Bull Run: ~1,000 days to all-time high of ~$19,800 in December 2017.

- Bear Decline: 364 days to ~$3,200 in December 2018.

- Key Events: Ethereum launch (2015), ICO boom.

Cycle 3: 2017-2021 (Third Halving: May 2020)

- Bear Bottom: December 2018 (~$3,200).

- Bull Run: ~1,050 days to ~$69,000 in November 2021.

- Bear Decline: ~370 days to ~$15,500 in November 2022.

- Key Events: COVID stimulus, institutional adoption (Tesla, MicroStrategy).

Cycle 4: 2021-2025 (Fourth Halving: April 2024)

- Bear Bottom: November 2022 (~$15,500).

- Bull Run: Projected ~1,066 days, peaking around mid-2025 at over $100,000 (as of December 2025, Bitcoin hovers around $95,000-$105,000 amid ETF inflows).

- Bear Decline: Expected ~400 days post-peak, bottoming in late 2026.

- Key Events: Spot ETF approvals (2024), nation-state adoption (El Salvador).

From $0 to over $100,000 in 16 years, Bitcoin’s compound annual growth rate exceeds 200% in bull phases.

How Altcoins Fit Into Bitcoin’s Cycles

Altcoins (alternative cryptocurrencies like Ethereum, Solana, or memecoins) often follow Bitcoin’s lead but with amplified volatility.

- Correlation: During Bitcoin bull runs, capital flows from BTC to alts (“altseason”), boosting their prices 5-10x more. In bears, alts crash harder (80-95% drops).

- Timing: Alts lag Bitcoin—rising later in the cycle and bottoming earlier.

- Examples: In 2017, Ethereum surged 100x during Bitcoin’s bull. In 2021, Solana and memecoins like SHIB exploded post-Bitcoin peak.

- Risks: Altcoins lack Bitcoin’s scarcity (no halvings), making them riskier. See Top 10 Cryptocurrencies Explained for Absolute Beginners in 2026 and Bitcoin vs Ethereum: Which is Better for Beginners in 2026.

Why Cycles Happen: Supply, Demand, and Psychology

- Supply Shock: Halvings halve inflation, mimicking gold’s scarcity.

- Demand Drivers: Adoption waves (retail, institutions, nations).

- Psychological Factors: Greed in bulls, fear in bears—cycles reflect human behavior.

External influences (e.g., interest rates, geopolitics) can shorten or extend phases.

Applying This to Your Strategy

- Buy Low: Enter near bear bottoms using DCA.

- Hold Through Volatility: Avoid selling in early bull dips.

- Diversify to Alts Cautiously: Only after Bitcoin stabilizes.

- Exit Strategy: Take profits near projected peaks.

Secure your holdings first: Use wallets like How to Set Up MetaMask Wallet: Step-by-Step Tutorial for Beginners 2026 or How to Set Up Trust Wallet: Step-by-Step Tutorial for Beginners 2026.

Potential Changes in Future Cycles

As Bitcoin matures, cycles may diminish (less volatility). The 2028 halving could see softer patterns with mainstream adoption.

Final Thoughts

Bitcoin’s 4-year cycle offers a roadmap for beginners—halvings spark 1066-day bulls from bottoms, followed by 400-day bears. From $0 in 2009 to over $100,000 in 2025, it’s a story of growth amid volatility. Altcoins ride the waves but with higher risks.

This understanding hubs into advanced trading: Time markets better, avoid emotional traps, and build wealth patiently. Start with How to Buy Bitcoin for Beginners: Complete Step-by-Step Guide 2026 and remember—crypto rewards the informed.

Happy cycling!

Get Weekly DeFi Alpha in Your Inbox

Weekly DeFi Alpha

56k+ traders getting my private newsletter every week

Join To Download our Ebook Free