Time-Based vs Threshold Rebalancing for Crypto Portfolios

- 25 Dec 2025

Understanding Time-Based vs Threshold Rebalancing Through a Story

Meet Carlos, a software engineer who recently dove into crypto investing. He started with a simple allocation: 50% Bitcoin, 30% Ethereum, 20% a basket of promising altcoins. At first, he didn’t worry much about rebalancing — “the market will sort itself out,” he thought.

Fast forward a few months: Bitcoin had a strong rally, Ethereum lagged a little, and some altcoins crashed hard. Carlos’s portfolio drifted heavily from his intended allocation. He realized that without rebalancing, his “balanced” portfolio was now more like a high-risk altcoin play. That’s when he decided to learn about time-based and threshold-based rebalancing.

Rebalancing isn’t just a technical step — it’s about keeping your portfolio aligned with your goals, managing risk, and avoiding emotional decision-making.

Related reading: How to Rebalance a Crypto Portfolio

What Is Time-Based and Threshold Rebalancing?

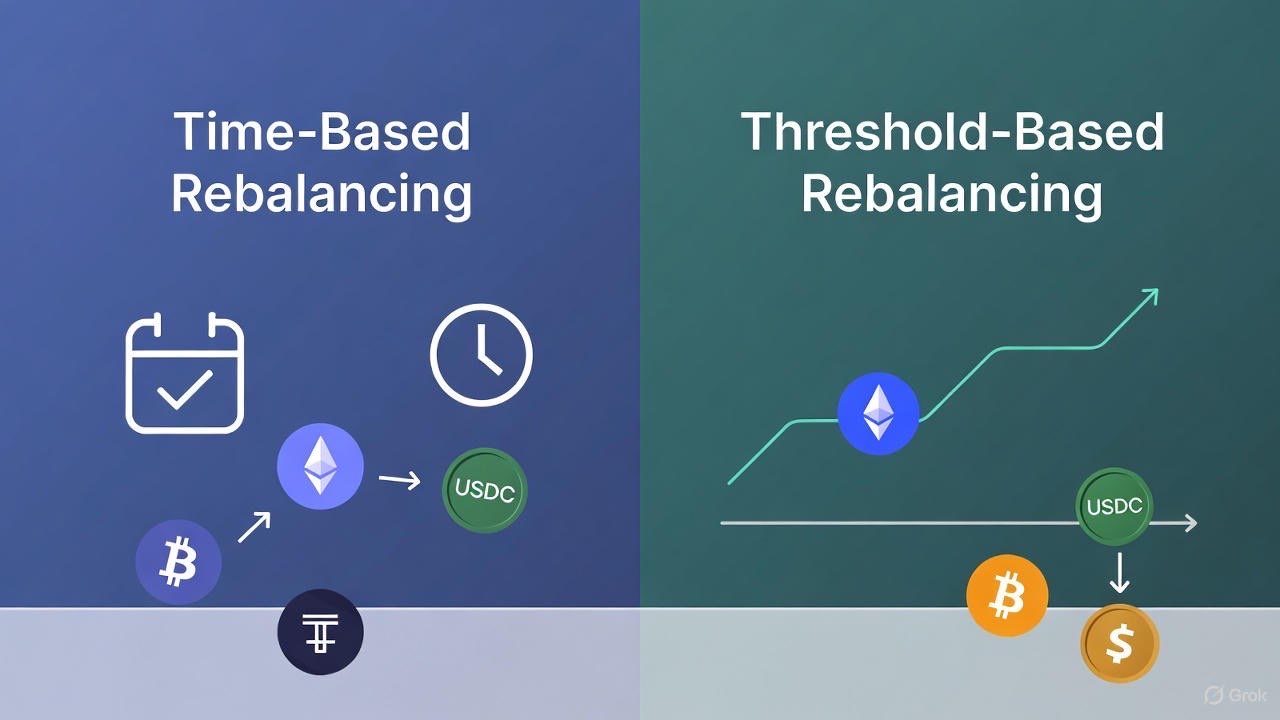

Time-Based Rebalancing

This method involves adjusting your portfolio at fixed intervals: weekly, monthly, or quarterly. You stick to a schedule regardless of how much each asset has moved.

Threshold-Based Rebalancing

Here, you only adjust when an asset’s weight moves beyond a set deviation from your target allocation. For example, if Bitcoin exceeds 45% of your portfolio when the target is 40%, you rebalance.

Carlos tried both approaches to see which fit his style. Time-based rebalancing gave him structure and discipline, but sometimes he traded unnecessarily. Threshold-based rebalancing helped him avoid extra trades, but he occasionally missed subtle drifts that added up over time.

Learn about other portfolio allocation strategies including Market Cap Weighted Allocation and Dynamic Allocation.

Pros and Cons of Each Method

Time-Based Rebalancing

Advantages:

- Predictable and easy to automate

- Keeps discipline consistent

- Helpful for beginners who don’t want to monitor constantly

Disadvantages:

- May rebalance when it’s not necessary

- Can incur more trading fees if markets are calm

- Sometimes overreacts to small, insignificant fluctuations

Threshold-Based Rebalancing

Advantages:

- Trades only when needed

- Reduces unnecessary fees

- Reacts to actual portfolio drift

Disadvantages:

- Requires tracking asset weights continuously

- May miss small but consistent drifts

- Could feel less disciplined if thresholds are too wide

Carlos found that a hybrid approach often works best: check monthly (time-based) but only trade if assets drift more than a set threshold (threshold-based). This gave him both discipline and efficiency.

For practical steps, see Step-by-Step Guide to Rebalancing.

How to Decide Which Method Fits You

When choosing a rebalancing method, consider:

- Portfolio Size: Small portfolios may not benefit from frequent rebalancing due to fees.

- Trading Costs: High-fee exchanges favor threshold-based adjustments.

- Volatility: Highly volatile altcoins may require tighter thresholds to avoid excessive drift.

- Personal Discipline: If you struggle to remember to rebalance, time-based schedules can help.

Imagine Maria, a casual investor, who sets a monthly rebalancing day on her calendar. Even during busy work weeks, she executes trades systematically. Meanwhile, her friend Leo, an active trader, prefers threshold-based rebalancing to react only when deviations exceed 5%, saving on fees during calm markets.

Related reading: Tracking Crypto Portfolio Performance

Step-by-Step Example: Hybrid Rebalancing

-

Set Target Allocation

- BTC 50%

- ETH 30%

- Altcoins 20%

-

Define Thresholds

- BTC ±5%

- ETH ±5%

- Altcoins ±5%

-

Schedule Monthly Review

- Review all positions once per month (time-based).

-

Check Threshold Breaches

- Only execute trades if the drift exceeds ±5%.

-

Rebalance

- Sell overweight assets and buy underweight assets to return to target allocation.

This approach helps limit emotional trading, reduce unnecessary fees, and maintain risk alignment.

Step-by-step illustration: How to Rebalance a Crypto Portfolio

Lessons Learned From Real Investors

- Carlos: Hybrid approach balanced discipline and flexibility.

- Maria: Time-based rebalancing fits her busy schedule.

- Leo: Threshold-based rebalancing prevents trading too often in stable markets.

All three achieved the same goal: keeping their portfolios aligned with long-term strategy, while managing risk in different ways.

See also Dynamic Portfolio Allocation for managing volatility dynamically.

Common Pitfalls to Avoid

- Ignoring trading fees, which can eat into returns

- Rebalancing emotionally during sudden market swings

- Setting thresholds too tight, resulting in over-trading

- Forgetting to track portfolio drift altogether

Carlos once panicked during a sudden altcoin pump and rebalanced without a plan, realizing afterward that he had sold part of his winners prematurely. From then on, he stuck to rules and thresholds, avoiding emotional mistakes.

For mistakes and best practices, see Common Rebalancing Mistakes

Benefits of Proper Rebalancing

- Reduces exposure to unintended risk

- Locks in gains systematically

- Improves long-term risk-adjusted returns

- Provides peace of mind by enforcing a disciplined approach

Rebalancing is like maintaining a car: regular checks prevent breakdowns and keep performance smooth.

Learn more about Portfolio Management Basics

Final Thoughts

Time-based and threshold-based rebalancing are tools, not magic bullets. The best strategy depends on your:

- Risk tolerance

- Trading fees

- Portfolio size

- Personal discipline

By understanding these methods and considering real-world scenarios like Carlos, Maria, and Leo, investors can maintain control, reduce risk, and improve long-term performance without reacting emotionally to every market move.

The key takeaway: rebalancing turns volatility into a controlled tool, helping you stay aligned with your goals and maintain a resilient crypto portfolio.

Get Weekly DeFi Alpha in Your Inbox

Weekly DeFi Alpha

56k+ traders getting my private newsletter every week

Join To Download our Ebook Free