What Is Kalshi? The Complete Beginner’s Guide to the Regulated Prediction Market Giant

- 29 Dec 2025

What Is Kalshi? The Complete Beginner’s Guide to the Regulated Prediction Market Giant

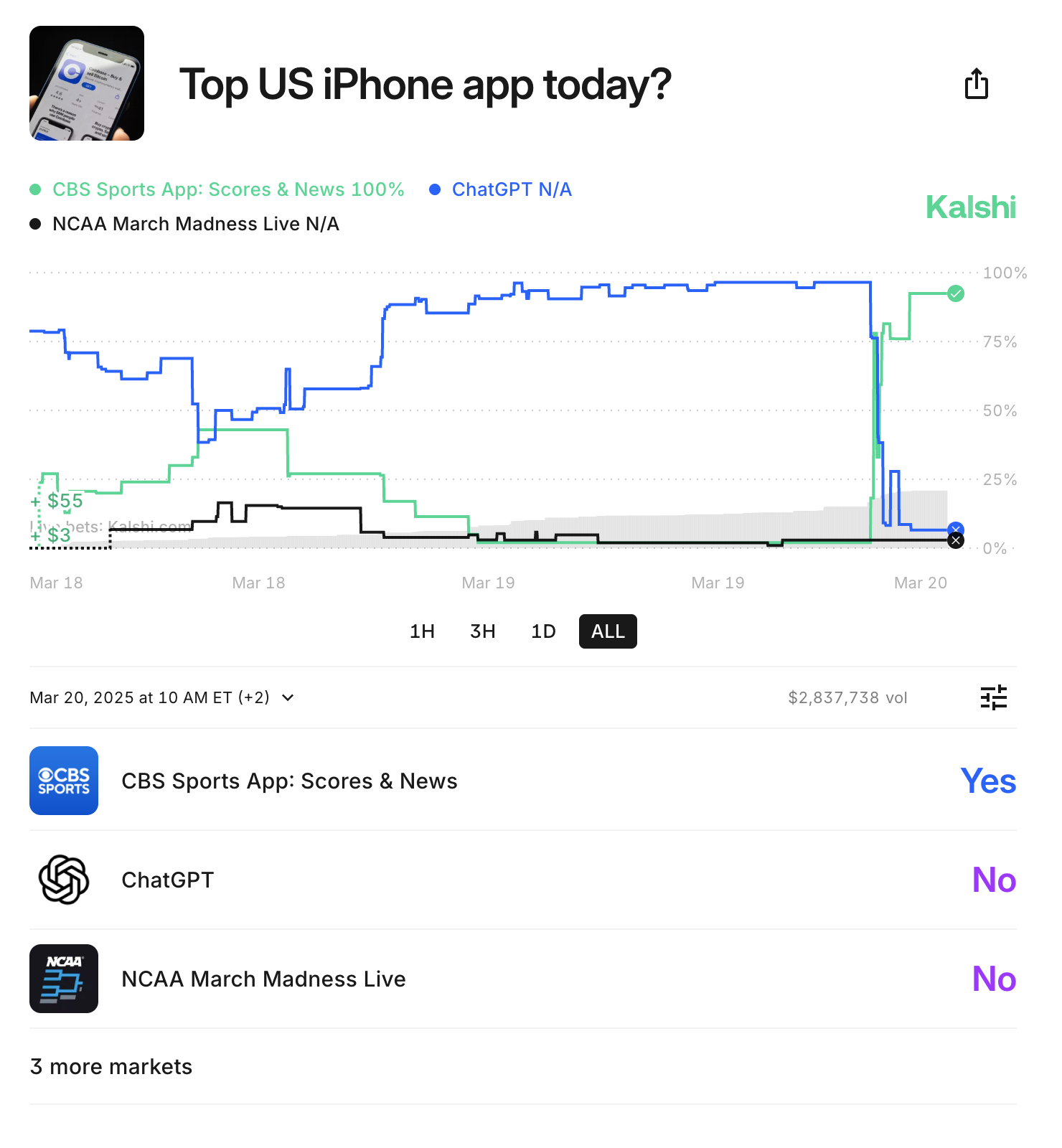

While crypto degens battled regulators on offshore platforms, Kalshi took the boring but brilliant route: full CFTC regulation. Launched in 2021, this New York-based exchange became the first federally overseen prediction market, trading event contracts on everything from elections to sports parlays, weather, and IPOs.

By late 2025, Kalshi hit $11 billion valuation after a $1 billion raise, processing billions in monthly volume, often outpacing Polymarket. Partnerships with CNN, CNBC, and even Phantom wallet for crypto access cemented its mainstream push. Over 90% of activity is now sports, but it started with macro events.

If our What Is Polymarket? guide showed the wild crypto side, Kalshi is the polished, legal Wall Street version, fiat-friendly and state-proof thanks to federal oversight.

How Kalshi Works (Simple Explanation)

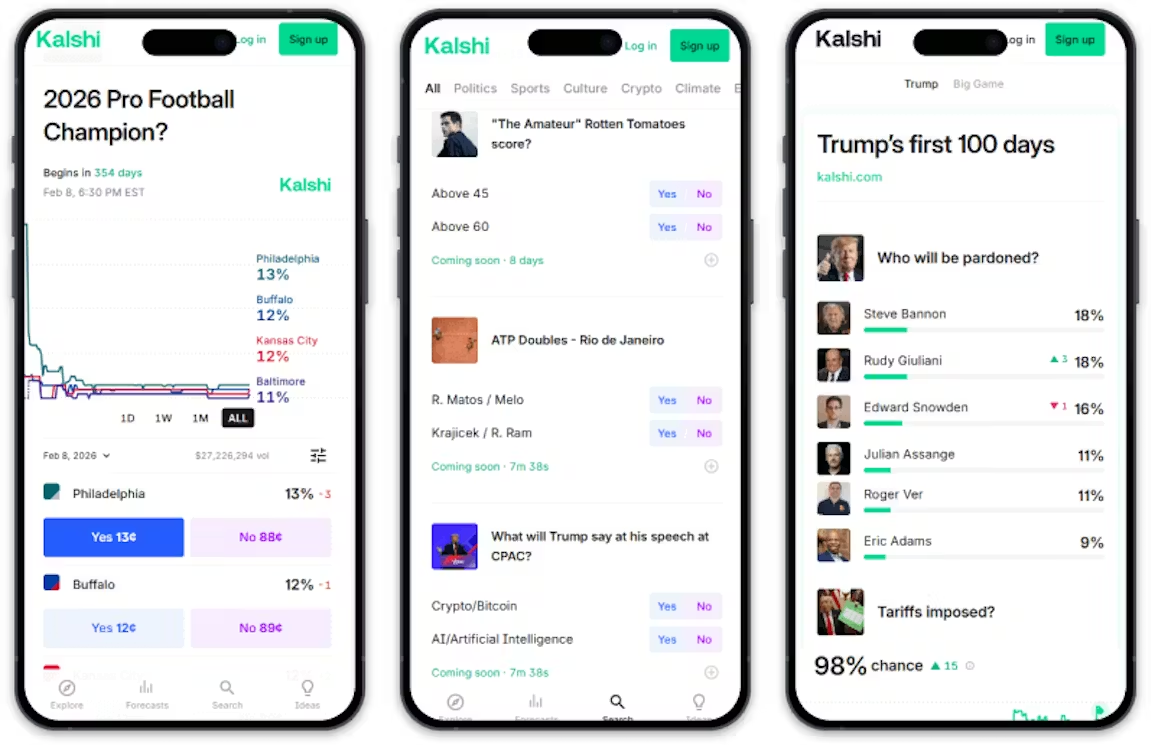

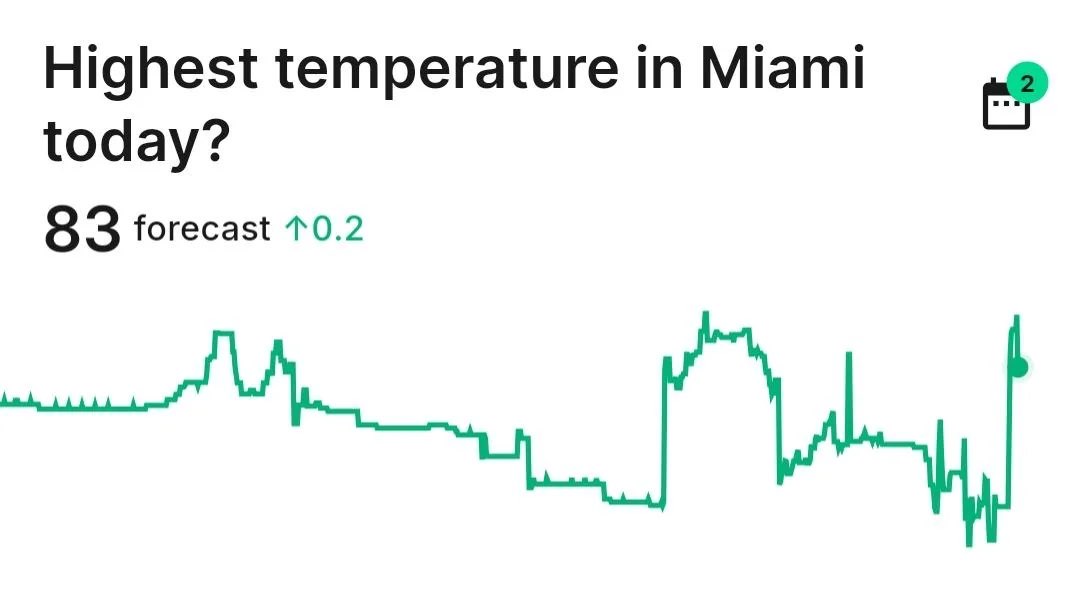

Kalshi offers binary event contracts: Yes/No on real-world outcomes, priced from $0.01 to $0.99 reflecting probability. Buy Yes if you think it happens, No otherwise. Correct? $1 payout. Wrong? Zero.

Markets cover politics (post-court wins), sports (including parlays and transfer portals), finance, climate, culture. Resolution uses official sources, automated where possible.

Self-certification lets quick listings, like college player transfers. Fiat deposits, no crypto needed originally, though now bridging in.

Why Kalshi Exploded in 2025

Regulation was the moat. Court victories over CFTC on elections, state pushback dismissed, opened floodgates. Massive funding fueled marketing, broker integrations, media deals.

Volume surged to $5-6 billion monthly peaks, app downloads soared. Sports dominance and parlays attracted gamblers seeking legal alternatives.

It turned prediction markets into a trillion-dollar vision, financializing opinions safely.

Kalshi vs Polymarket, Worm.wtf, and Augur: Key Advantages

The regulated vs decentralized showdown.

Against Polymarket: Both hit billions in volume, but Kalshi wins US legality, fiat ease, no VPN nonsense. Polymarket edges global crypto access, niche markets. Kalshi feels like a stock app; Polymarket like a degen playground.

Against Worm.wtf: Solana’s creator-focused chaos contrasts Kalshi’s institutional polish. Worm cheaper and faster for crypto natives, but Kalshi offers regulatory safety, broader events including sports parlays.

Against Augur: The decentralized pioneer lacks Kalshi’s liquidity, UX, volume. Kalshi provides trust via CFTC, easier onboarding. Augur uncensorable; Kalshi compliant and massive scale.

Overall, Kalshi dominates for US users wanting legal, high-volume trading without crypto hassle.

Who Should Use Kalshi?

Americans seeking regulated exposure, sports fans loving parlays, macro traders hedging real events. Beginners appreciate fiat and app simplicity.

Less for global degens craving wild topics or low fees, Polymarket or Worm better there.

How to Get Started on Kalshi (Step-by-Step)

-

Download the Kalshi app or visit kalshi.com.

-

Sign up with ID verification (KYC required).

-

Deposit fiat via bank.

-

Browse markets in sports, politics, etc.

-

Buy Yes/No contracts.

-

Trade or hold to settlement.

Snappy mobile experience, bonuses via referrals.

Is Kalshi Safe and Legit?

CFTC-regulated DCM, full oversight, surveillance partnerships. Faces state gambling lawsuits but federal preemption holds. Typical risks: low liquidity niches, but strong for majors. Start small.

Final Thoughts — Is Kalshi Worth Trying in 2025?

Kalshi turned prediction markets mainstream, proving regulation can fuel explosion rather than kill it. With sports dominance and media ties, it is the gateway for millions into event trading.

If legality and scale matter, this is your platform. The tortoise won the race.

Check out the rest of our Prediction Markets category for deep dives on other platforms. Next up: more guides to help you navigate this growing space.

Get Weekly DeFi Alpha in Your Inbox

Weekly DeFi Alpha

56k+ traders getting my private newsletter every week

Join To Download our Ebook Free