On-Chain Due Diligence: What Wallet Activity Reveals Before Price Moves

- 01 Jan 2026

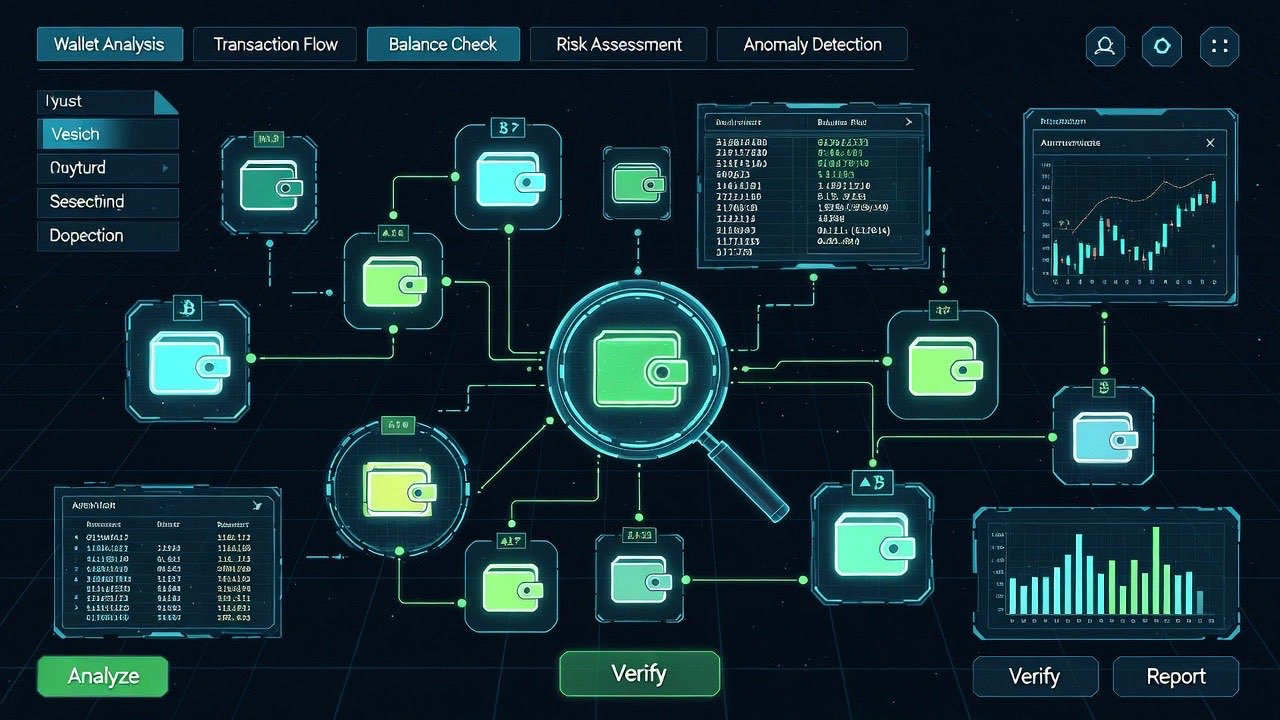

Introduction: Why Wallet Analysis Matters

In crypto, on-chain data is the truth. Marketing, social media hype, and project announcements are often misleading. Wallet activity provides real insight into investor sentiment, distribution, and potential market moves.

This guide is part of the Due Diligence Framework cluster, complementing:

The Ultimate Crypto Due Diligence Framework

How to Perform Due Diligence on a Crypto Project in Under 60 Minutes

Red Flags That Kill Crypto Investments

By the end of this article, you’ll understand how to read wallet data to make smarter investment decisions.

Step 1: Identify Key Wallets

Focus on the wallets that matter most:

- Founders & Team Wallets: Can signal selling pressure or commitment.

- Investor/VC Wallets: Often have lockups; large movements matter.

- Whale Wallets: Can move markets; track accumulation and distribution.

- Exchange Wallets: Deposits often precede selling; withdrawals may signal accumulation.

Tools for tracking:

- Etherscan / BSCScan / Solscan

- Nansen / Dune / Glassnode dashboards

- Whale Alert for large transactions

Step 2: Monitor Wallet Concentration

Wallet concentration provides insight into risk and distribution:

- High Concentration: Few wallets hold most tokens → higher risk of dump

- Low Concentration: Distributed holdings → stronger stability

Check token holders list to see the top 10–20 wallets and their percentage holdings.

Step 3: Track Large Transfers and Whale Movements

Large wallet movements can signal:

- Impending sell pressure

- Strategic accumulation

- Coordination among investors or teams

Look for:

- Transfers from private wallets to exchanges (potential selling)

- Exchange withdrawals (accumulation by whales)

- Recurrent patterns in token transfers

Step 4: Evaluate Liquidity and DEX Activity

Liquidity tells you how easily a token can be bought or sold:

- Track liquidity pools and depth

- Observe sudden inflows/outflows

- Watch for pool manipulation or sudden withdrawal of liquidity

Decentralized exchanges are public; activity here can reveal investor behavior before price moves.

Step 5: Assess Active Users vs Holders

Usage signals adoption:

- Compare number of active wallets to total holders

- Assess whether activity is growing organically

- Track repetitive addresses to identify bots or farming schemes

Strong on-chain usage indicates real product-market fit and long-term potential.

Step 6: Integrate On-Chain Findings into Decision-Making

Combine insights from wallet concentration, whale movements, liquidity, and active user metrics with your broader due diligence framework:

- Tokenomics analysis: Are whales aligned with community incentives?

- Team credibility: Are team wallets selling or holding?

- Red flags: Large dumps, opaque wallets, suspicious patterns

For a practical summary and structured approach, see:

The Crypto Due Diligence Checklist

Step 7: Tools and Automation

Efficient tracking requires the right tools:

- Dashboards: Nansen, Dune, Glassnode

- Alerts: Whale Alert, Telegram bots, custom scripts

- Explorers: Etherscan, Solscan, BSCScan for wallet-specific queries

Automation helps monitor dozens of wallets without manual effort, especially for fast-moving tokens.

Step 8: Practical Example

- Identify top 5 investor wallets

- Track transfers to exchanges over 7 days

- Compare inflows/outflows to total liquidity

- Note wallet concentration changes

- Adjust investment thesis accordingly

This method highlights potential selling pressure and accumulation trends before the market reacts.

Conclusion

On-chain wallet analysis turns transparency into an actionable advantage. By monitoring wallets, liquidity, and user activity, investors can identify red flags, evaluate tokenomics alignment, and anticipate market movements.

Integrate this approach with your broader due diligence process for maximum insight:

- Ultimate Crypto Due Diligence Framework

- 60-Minute Crypto Due Diligence

- Red Flags That Kill Crypto Investments

- Crypto Due Diligence Checklist

With consistent application, wallet analysis becomes a core part of informed crypto investing.

Get Weekly DeFi Alpha in Your Inbox

Weekly DeFi Alpha

56k+ traders getting my private newsletter every week

Join To Download our Ebook Free