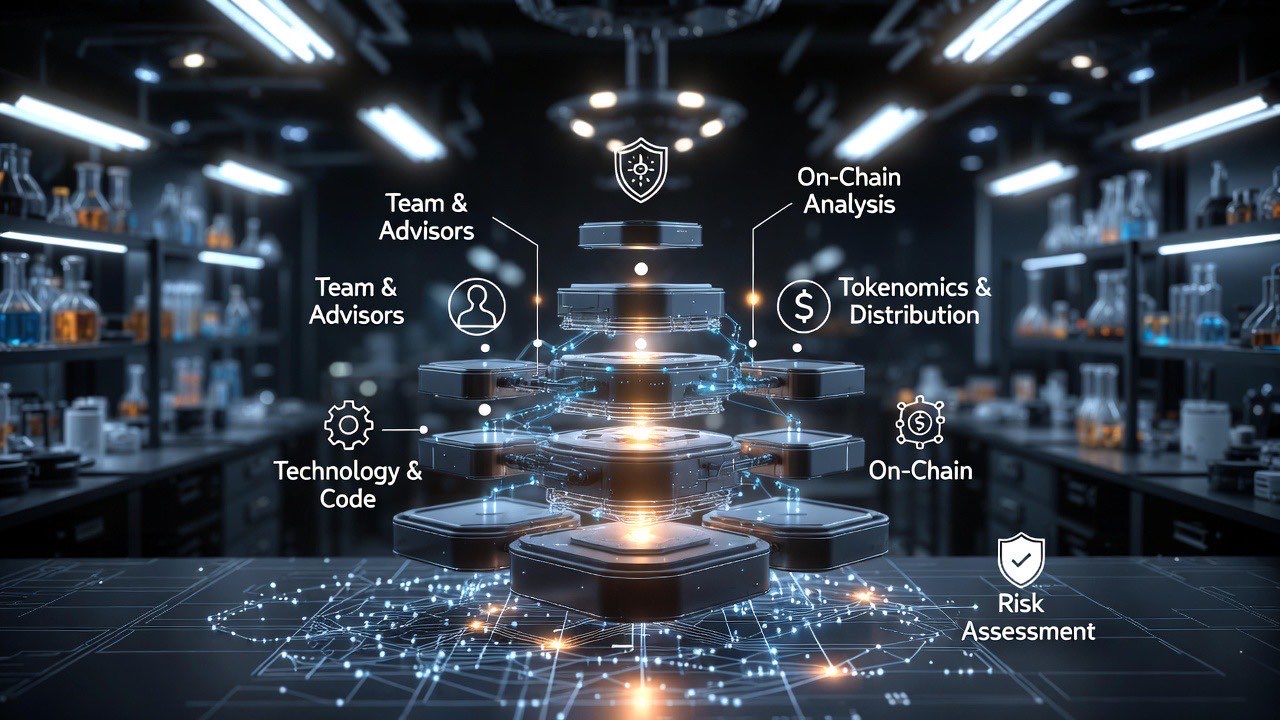

The Ultimate Crypto Due Diligence Framework (Step-by-Step)

- 01 Jan 2026

Introduction: Why Due Diligence Matters in Crypto

Crypto markets reward speed, conviction, and timing—but they punish lazy research. Unlike traditional markets, crypto projects often launch with minimal disclosures, anonymous teams, rapidly changing roadmaps, and token structures designed more for speculation than sustainability.

This is why a repeatable due diligence framework matters.

Due diligence does not eliminate risk. Instead, it helps you avoid unnecessary risk—projects with weak fundamentals, misaligned incentives, or structural flaws that eventually surface regardless of market conditions.

This guide presents a step-by-step crypto due diligence framework that can be applied to any token, protocol, or blockchain project. It is designed to be:

- Modular

- Time-efficient

- Evergreen

- Usable for both long-term investors and active traders

Later articles in this cluster expand on individual components, including a compressed version for speed and deeper on-chain analysis techniques.

Step 1: Define the Investment Context

Before analyzing a project, clarify why you are evaluating it. Context determines how much depth is required and which risks matter most.

Ask yourself:

- Is this a long-term investment or a short-term trade?

- Are you investing based on fundamentals, narratives, or momentum?

- What is your time horizon?

- How large will the position be relative to your portfolio?

A project suitable for a short-term momentum trade may be entirely unsuitable for a long-term hold. Due diligence begins by aligning expectations with reality.

Step 2: Identify the Problem and Value Proposition

Every legitimate crypto project attempts to solve a problem. Your task is to determine whether:

- The problem actually exists

- Blockchain technology is necessary

- The solution is meaningfully differentiated

Key questions:

- Who is the target user?

- What pain point does the project address?

- Why is a token required?

- What happens if the project fails to gain adoption?

If the value proposition cannot be explained clearly in one or two sentences, that is an early warning sign.

Step 3: Evaluate the Tokenomics

Tokenomics define how value flows through a system. Poor token design can destroy otherwise strong products.

Key areas to analyze:

Supply Structure

- Total supply vs circulating supply

- Inflation rate and emission schedule

- Maximum supply constraints

Distribution

- Team allocation

- Investor and advisor allocations

- Community and ecosystem incentives

Vesting and Unlocks

- Cliff periods

- Linear vs lump-sum unlocks

- Known unlock dates and sizes

Misaligned tokenomics often lead to sustained sell pressure, especially during unlock events. This is a common cause of long-term underperformance.

For a deeper breakdown of time-efficient token analysis, see

How to Perform Due Diligence on a Crypto Project in Under 60 Minutes

Step 4: Analyze the Team and Governance

Crypto projects are built by people. Assessing the team helps determine whether a project can execute.

Evaluate:

- Founder background and experience

- Prior startups or protocol involvement

- Public presence and accountability

- GitHub activity and contribution history

Anonymous teams are not automatically disqualifying, but they increase execution and trust risk. Transparency, even without full doxxing, matters.

Governance considerations include:

- Who controls protocol upgrades?

- How decentralized decision-making is

- Whether token holders have real influence

Step 5: Assess On-Chain Activity

On-chain data reveals behavior that marketing cannot hide. This is one of crypto’s biggest advantages over traditional markets.

Key signals include:

- Wallet concentration

- Whale accumulation or distribution

- Developer wallet activity

- Liquidity depth and movement

Unusual wallet behavior often precedes major price moves.

A full walkthrough of these techniques is covered in

On-Chain Due Diligence: What Wallet Activity Reveals Before Price Moves

Step 6: Evaluate Product and Market Fit

Adoption matters more than narratives.

Assess whether the project shows signs of real usage:

- Active wallets

- Transaction volume quality

- User retention

- Organic growth vs incentives

Ask:

- Are users paying to use the product?

- Does usage persist when incentives decline?

- Is growth sustainable?

Speculative demand alone does not equal product-market fit.

Step 7: Competitive Landscape Analysis

No crypto project exists in isolation.

Analyze:

- Direct competitors

- Alternative solutions

- Barriers to entry

- Network effects or switching costs

A strong project either:

- Does something meaningfully better, or

- Does something meaningfully cheaper, or

- Has a defensible niche

If competitors can replicate the product easily, long-term value capture becomes difficult.

Step 8: Risk Assessment

Every investment carries risk. Due diligence makes risk visible.

Common crypto risks include:

- Smart contract vulnerabilities

- Regulatory uncertainty

- Token dilution

- Centralization of control

- Liquidity risk

A structured risk review helps you decide whether potential upside justifies exposure.

Many investors skip this step entirely, which is why losses often feel “unexpected” in hindsight.

Step 9: Identify Red Flags Early

Some warning signs justify walking away immediately.

Examples include:

- Unrealistic yield promises

- Constant roadmap changes

- Opaque token distributions

- Heavy insider selling

- Aggressive marketing without substance

A full list of high-signal warnings is covered in

Red Flags That Kill Crypto Investments (Before You Lose Money)

Step 10: Synthesize and Decide

The final step is synthesis.

Ask:

- What is the strongest argument for this investment?

- What is the strongest argument against it?

- What would invalidate your thesis?

If you cannot clearly articulate both sides, more research is needed.

Position sizing matters as much as conviction. Even strong projects can fail.

Using This Framework Efficiently

Not every investment requires full-depth analysis. This framework is designed to scale.

- Long-term holds: run all steps

- Medium-term positions: focus on tokenomics, team, and on-chain data

- Short-term trades: prioritize liquidity, wallet behavior, and catalysts

For a compressed workflow, see

How to Perform Due Diligence on a Crypto Project in Under 60 Minutes

Final Thoughts

Crypto due diligence is not about predicting the future. It is about avoiding preventable mistakes and improving decision quality over time.

A disciplined framework turns randomness into probability and speculation into informed risk-taking.

For a practical, printable version of this process, refer to

The Crypto Due Diligence Checklist

Used consistently, this framework becomes a competitive advantage.

Get Weekly DeFi Alpha in Your Inbox

Weekly DeFi Alpha

56k+ traders getting my private newsletter every week

Join To Download our Ebook Free