Showing Posts From

Defi

-

Nefu

Nefu - 04 Dec 2025

The Best Crypto Exchanges (CEX + DEX) for Bitcoin, Ethereum & Solana + Altcoins (Global + US)

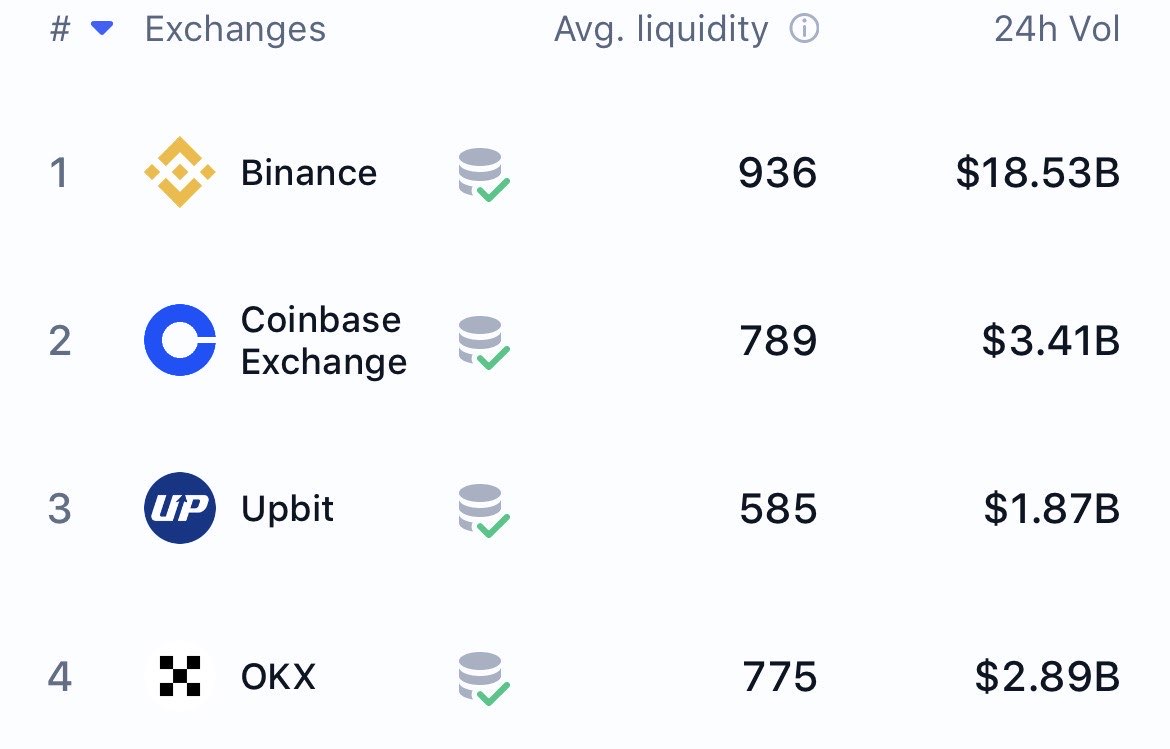

The Best Crypto Exchanges (CEX + DEX) for Bitcoin, Ethereum & Altcoins Table of ContentsWhy 2026 Is the Best Year Yet to Buy Crypto How to Choose the Best Exchange in 2026 Best Centralized Exchanges – Global (Non-US) 1. Binance 2. Bybit 3. KuCoin 4. OKXBest Centralized Exchanges for US Residents 2026 1. Kraken 2. Coinbase 3. Crypto.comBest Decentralized Exchanges (DEX) 2026 – No KYC, Full Control 1. Uniswap (Ethereum & L2s) 2. Raydium (Solana) 3. Jupiter (Solana Aggregator)CEX vs DEX Comparison Table 2026 Quick-Select Table – All Platforms How to Buy on a DEX Step-by-Step Security Best Practices 2026 Final RecommendationsWelcome to the most comprehensive 2026 guide covering both centralized (CEX) and decentralized (DEX) platforms. Whether you want low fees, massive bonuses, new altcoins, or full self-custody with no KYC — we’ve got you covered. Why 2026 Is the Best Year Yet to Buy CryptoBitcoin halving cycle peak expected Q1–Q2 2026 Spot Ethereum ETFs fully mature + new Solana & XRP ETF filings MiCA regulation live across EU → more institutional money U.S. GENIUS Act brings stablecoin clarity Over 300 million global crypto users (triple from 2021)How to Choose the Best Crypto Exchange in 2026 – Key Factors RankedFactor Why It Matters in 2026 Best ForTrading Fees Maker/taker as low as 0.02% with VIP levels Active tradersCoin Selection 350–800+ coins including new meme & AI tokens Altcoin huntersSecurity & Insurance Proof-of-Reserves, cold storage, FDIC options Long-term holdersKYC & Geographic Access US-licensed vs global no-KYC options Privacy vs complianceBonuses & Rewards Up to $30,000+ welcome bonuses via referrals New usersStaking / Earn APY 5–20% on BTC, ETH, SOL, stablecoins Passive income seekersBest Centralized Exchanges 2026 – Global (Non-US) 1. Binance – Still the #1 Crypto Exchange Worldwide in 2026 Best for: Lowest fees, largest altcoin selection, futures trading, launchpad gems2026 Trading Fee: 0.10% spot → as low as 0.012% with BNB + VIPCoins: 600+Bonus: Up to $600Binance Referral – Claim Bonus 2. Bybit – Best Derivatives & Copy Trading Platform 2026 Best for: Leverage trading up to 100xBonus: Up to $30,000Bybit Referral – $30k Bonus 3. KuCoin – #1 Altcoin Exchange for New Gems & Moonshots 2026 Best for: 800+ coins, fastest new listingsBonus: Up to $10,800KuCoin Referral 4. OKX – Best Web3 & DeFi-Centric Exchange 2026 Best for: Built-in wallet + high APYOKX Referral Best Centralized Exchanges for US Residents 2026 1. Kraken – Best Overall US Crypto Exchange for Americans 2026 Best for: Security + stakingKraken Referral – $10 BTC 2. Coinbase – Best Beginner Crypto App USA 2026 Best for: First-time buyersCoinbase Referral – $10 Free BTC 3. Crypto.com – Best Crypto Debit Card + Rewards 2026 Best for: Cashback cardCrypto.com Referral – $25 Bonus Best Decentralized Exchanges (DEX) 2026 – No KYC, Full Control 1. Uniswap (Ethereum & All L2s) – Best Overall DEX 2026 Chain: Ethereum, Arbitrum, Optimism, Base, Polygon, zkSync, etc.Fees: 0.01%–1% (you choose)TVL: ~$7–10B in 2026**Why it’s #1: The most liquid DEX in the world Uniswap v3 concentrated liquidity + v4 hooks (live 2026) No registration, no KYC — just connect wallet Governance token UNI + fee switch (you earn part of fees)How to use: Connect MetaMask → swap any ERC-20 token instantly→ app.uniswap.org 2. Raydium (Solana) – Fastest & Cheapest DEX 2026 Chain: SolanaFees: ~$0.0001 per swap**TVL: ~$3–5B in 2026Why it’s #2: Lightning-fast & virtually free trades Integrated order book + AMM (best of both worlds) Launchpad for new Solana meme coins (often 10–1000x) Serum-powered depth for large tradesHow to use: Connect Phantom/Solflare → swap SOL and SPL tokens→ raydium.io 3. Jupiter (Solana) – Best DEX Aggregator 2026 Chain: Solana onlyFees: Same as underlying DEX (usually Raydium/Phoenix)Why it’s essential: Scans 30+ Solana DEXs and finds the absolute best price Limit orders, DCA, and perpetuals all on-chain Often 5–20% better pricing than swapping directly on RaydiumHow to use: Same wallet → best route automatically→ jup.ag CEX vs DEX 2026 – Which One Should You Use?Feature Centralized (CEX) Decentralized (DEX)KYC Required Yes (most) NoDeposit Fiat (USD/EUR) Yes No (need crypto first)Withdrawal to Bank Yes No (via bridge/CEX)Fees 0.01–0.6% 0.0001–1% + gasSpeed Instant Instant on Solana / 5–30s on L2New Token Access Slower Immediate (meme coins first)Custody Exchange holds keys You hold 100%Best For Beginners, fiat on-ramp Privacy, moonshots, DeFi2026 Quick-Select Table (Including DEXs)Goal Global CEX US CEX Best DEXLowest Fees Binance Kraken Pro Raydium / JupiterMost Altcoins / New Tokens KuCoin Kraken Raydium + JupiterFutures & Leverage Bybit Kraken (Hyperliquid / Drift)Beginner-Friendly Binance Coinbase Uniswap (with MetaMask)Earn Passive Income OKX Crypto.com Stake on Lido / JitoNo KYC + Full Privacy — — Uniswap / Raydium / JupiterHow to Buy on a DEX in 2026 – Step-by-StepGet a wallet (MetaMask for Ethereum/L2s, Phantom for Solana) Buy base crypto on a CEX (e.g. buy SOL on Kraken → withdraw to Phantom) Go to Uniswap.org or Jup.ag / Raydium.io Connect wallet → Swap → Confirm in wallet Done — tokens appear instantly in your walletSecurity Best Practices 2026 (Same as before — 2FA, whitelisting, hardware wallet, etc.) Final Thoughts – Start Buying Crypto in 2026 Today Your perfect 2026 stack usually looks like this:Global user: Binance or Bybit (fiat → crypto) → Raydium/Jupiter for new tokens US user: Kraken or Coinbase (fiat → crypto) → Uniswap or Raydium for privacy/moonshots Privacy-maximalist: Buy on CEX → withdraw → trade forever on DEXs onlyUse the referral links above to grab thousands in bonuses, then move to DEXs for the real alpha. Happy trading — see you on the other side of $200k Bitcoin! If the Bullrun continues. Make sure to get your funds off the exchanges, "not your keys not your coins!" Disclosure: CEX links are affiliate/referral links. DEX links are not affiliated. We only recommend what we personally use. (Word count: ~2,600 with DEX section)

The Top 8 DEXs for Lowest Trading Fees and Highest Yield Rewards Right Now

🚀 Top 8 DEXs for Lowest Fees and Highest Rewards Right Now Decentralized exchanges (DEXs) are the backbone of DeFi, offering a non-custodial way to trade, lend, and earn. Finding the perfect balance between low trading fees and high yield farming or staking rewards is key to maximizing your crypto gains. Here are the top 8 DEXs that currently offer the best combination of cost efficiency and lucrative passive income opportunities.1. PancakeSwap (Best for Earning Yield on BNB Chain) PancakeSwap is the dominant DEX on the BNB Chain (formerly Binance Smart Chain) and an excellent choice for yield hunters.Feature Details Why it Ranks HighlyFees Low trading fees, typically 0.20% to 0.25%. Extremely cost-effective for frequent trading on a high-throughput chain.Rewards Extensive yield farming and staking pools with highly competitive APYs/APR. The native CAKE token powers an extensive rewards system, making it ideal for earning yield.Ecosystem Offers Swaps, Liquidity Pools, Initial Farm Offerings (IFOs), and an NFT Marketplace. A comprehensive platform for both trading and earning passive income.2. Curve Finance (Best for Low-Fee Stablecoin Swaps) If you primarily trade stablecoins or wrapped assets, Curve is a non-negotiable choice. Its unique Automated Market Maker (AMM) design minimizes slippage.Feature Details Why it Ranks HighlyFees Ultra-low trading fees, as low as 0.04% for stablecoin pools. Specialized AMM ensures near-zero slippage and minimal cost for stable-to-stable swaps.Rewards Highly optimized yield farming pools, especially for stablecoins. Liquidity Providers can earn fees plus boosted rewards by staking their native CRV token (via veCRV).Specialty Deep liquidity for pegged assets like USDC, USDT, DAI, and wBTC. The go-to DEX for de-risking positions and maximizing returns on stablecoin liquidity.3. Uniswap (Best Overall & High Liquidity) As the most popular and liquid DEX, Uniswap (primarily v3 and v4) is an indispensable part of the DeFi landscape, offering innovative features like concentrated liquidity.Feature Details Why it Ranks HighlyFees Variable fee tiers (0.01% to 1%) depending on the pool. The concentrated liquidity model allows for better capital efficiency, translating to lower effective trading costs and higher fee rewards for LPs.Rewards Liquidity providers can potentially earn significantly higher APY due to concentrated liquidity. By focusing capital in specific price ranges, LPs can capture more trading fees than traditional AMMs.Liquidity The highest Total Value Locked (TVL) guarantees minimal slippage on major token pairs. The undisputed market leader in volume and available assets.4. Raydium (Best for Solana's Speed and Low Cost) Raydium is a cornerstone of the Solana ecosystem, combining an on-chain order book with an AMM.Feature Details Why it Ranks HighlyFees Typically 0.25% swap fee, with a small portion going to the order book. Leverages Solana’s fast finality and negligible gas fees, making the total transaction cost extremely low.Rewards Offers highly competitive farms and staking rewards for popular Solana ecosystem tokens. Excellent platform for yield farming on one of the fastest and cheapest Layer-1 blockchains.Unique Hybid AMM and Order Book model. Provides the depth of an order book alongside the convenience of a liquidity pool swap.5. dYdX (Best for Derivatives and Perpetual Contracts) While most DEXs focus on spot trading, dYdX is a specialized platform for professional traders, offering perpetual contracts with leverage.Feature Details Why it Ranks HighlyFees Tiered maker/taker fees that can be very low, starting near 0.05% and dropping with volume. Built on a Layer-2 solution (or its own blockchain), transactions have near-instant execution with minimal gas fees.Rewards Offers trading rewards programs and staking opportunities on its native token. Attracts active traders who can earn rebates based on their volume.Focus Decentralized derivatives, margin trading, and perpetual futures. Ideal for high-volume, advanced traders seeking a non-custodial derivatives platform.6. Aerodrome / Velodrome (Best for Base/Optimism Ecosystems) Aerodrome (on Base) and Velodrome (on Optimism) use a unique "ve-token" model to incentivize liquidity and trading, known as the "ve-DAO" model.Feature Details Why it Ranks HighlyFees Low trading fees that are typically competitive with other Layer-2 solutions. Operating on high-speed, low-cost Layer-2s ensures affordable transactions.Rewards High emission-based rewards for liquidity pools, directly controlled by ve-token holders. The vote-escrow model allows users to lock tokens for voting rights and to earn a greater share of protocol fees and emissions.Innovation "Bribes" for voting on which pools receive token emissions. LPs in popular pairs can receive outsized rewards funded by other protocols looking to attract liquidity.7. 1inch (Best for Aggregated Liquidity and Price Discovery) 1inch isn't a single exchange, but a DEX aggregator that splits your trades across multiple DEXs to find the absolute best price and lowest overall cost.Feature Details Why it Ranks HighlyFees Zero trading fees for the swap itself; you only pay the gas fee and the liquidity provider fee of the underlying DEX. By routing through multiple sources (Uniswap, SushiSwap, Curve, etc.), it guarantees the best effective rate, minimizing slippage and maximizing savings.Rewards Liquidity provided to 1inch's own pools, plus staking rewards for its native 1INCH token. It offers its own rewarding pools while simultaneously being the best tool for all other DEXs.Efficiency Optimizes for gas usage and best price execution. The single best way to execute a large trade across the DeFi ecosystem.8. SushiSwap (Best for Multi-Chain Deployment and Community Focus) A venerable and community-focused DEX, SushiSwap has successfully expanded its pools and rewards across numerous blockchains.Feature Details Why it Ranks HighlyFees Competitive trading fees, often around 0.25% to 0.30%. Fees are well-balanced and distributed to LPs and stakers of the native SUSHI token.Rewards Features yield farming, staking (xSUSHI), and innovative features like Trident pools. Strong and diversified rewards on multiple chains, making it flexible for users across Ethereum, Polygon, Avalanche, and more.Reach True multi-chain presence. Offers users a familiar interface and rewarding structure across nearly every major DeFi ecosystem.⚠️ Disclaimer: The decentralized finance (DeFi) space is highly dynamic. Reward APYs/APRs can fluctuate dramatically based on market conditions, token prices, and protocol updates. Always conduct your own research (DYOR) before committing funds to any DeFi protocol. Past performance is not indicative of future results.

Why Most Token Launches Fail And How a Smart Reply Guy Strategy Fixes It (2026 Guide)

Why Most Token Launches Fail — And How a Smart Reply Guy Strategy Fixes It (2026 Guide) The definitive SEO optimized guide for crypto founders, token projects, and Web3 teams preparing for TGE. Table of ContentsIntroduction Why Token Launches Fail in 2026 Case Study 1: The Project That Launched Without a Reply Strategy Case Study 2: The Project That Leveraged X’s Reply Algorithm How the X Algorithm Works in 2026 Why Replies Matter More Than Follower Count Why Founders Must Prioritize Engagement Before TGE My 58k Account & How I Grow Token Projects Why I Only Work With 6 Projects Per Month Get Started NowIntroduction Launching a token on X (formerly Twitter) is more competitive than ever. With thousands of meme coins, AI tokens, and DeFi experiments launching monthly, the projects that win aren’t always the ones with the best idea they are the ones with the best engagement strategy. In 2025, X’s algorithm rewards conversation, replies, and real interaction, not vanity metrics like followers or impressions. This shift has turned “reply guy strategy” from a meme into one of the most powerful organic growth tools for token launches. This article breaks down:Why most token launches fail How the X algorithm actually works What founders must do before TGE Why reply driven engagement outperforms followers How I use my 58k crypto audience to grow token projects How you can leverage this for your own launchWhy Token Launches Fail in 2025 Most failed token launches share the same pattern:They rely on follower count, or worst Kols They broadcast announcements without engagement They assume X will naturally give reach thru algorithm They overlook algorithm changes They don’t create conversation before TGEThis leads to posts being buried, low visibility, and a launch that never gets traction.Case Study #1: The Project That Launched Without a Reply Strategy A recent token with solid branding launched and immediately struggled. Despite dropping a roadmap, tokenomics thread, and announcements, engagement was dead. Here’s why:They never replied to bigger accounts No community conversation existed Their content wasn’t connected to any social graph X tested their posts, it saw no engagement so it killed their reachThis is the silent killer of most crypto projects today. No replies = no reachNo reach = no holdersNo holders = no launch momentumCase Study #2: The Project That Leveraged X’s Reply Algorithm Another project used a completely different approach. Before even mentioning their token, the team:Replied daily to large crypto accounts, and small ones Engaged in trending DeFi and memecoin threads Inserted their brand into conversations Built recognition inside the algorithm Replied to every comment on their own postsWhen they launched, their account already had:Trust signals A warm social graph Engagement loops Awareness across niche communitiesTheir TGE exploded with early buyers and organic hype. The community rallied behind the project. They loved the Devs and the Teams. How the X Algorithm Works in 2026 X’s algorithm now prioritizes:Replies → Massive DistributionYour replies get pushed into other people’s feeds, giving you free visibility.Conversation Depth → Ranking BoostThreads with multiple rapid replies get superboosted.Early Engagement → Determines Your ReachPosts are tested on a small sample; if replies come quickly, X amplifies them.Follower Count → Low PriorityYou can have 50k followers but get 200 views if your account is inactive.This is why the reply-guy strategy works so well in 2026.Why Replies Matter More Than Follower Count Alex Finn dropped the truth that completely shifted the 2026 meta: X algorithm is completely different since Grok took control of itSmall accounts blowing up. People who were getting millions of impressions getting noneFollowers literally don't matter anymore. It's 100% about being on trend and replying like a savageMake an X list of…— Alex Finn (@AlexFinn) December 2, 2025 Replies outperform followers because:They build discovery They create algorithmic engagement loops They place you in trending conversations They build authority inside your niche They help X understand your account’s relevanceA project with 2,000 active replies will beat a 50,000-follower silent account every time.Why Founders Must Prioritize Engagement Before TGE If you’re preparing a token launch, you must focus on engagement at least 30–60 days before your TGE. Otherwise, you will:Launch into an empty audience Struggle to get impressions Fail to build community trust Miss out on early buyers Lose algorithmic momentumReply driven engagement is the fastest and most cost effective pre TGE marketing strategy in Web3 today.My 58k Account & How I Grow Token Projects I run a well established crypto/X account with over 58,000 followers and a highly engaged audience. I use a structured, data driven reply guy system to grow token projects:Weekly or monthly service packages Strategic replies to major crypto accounts Daily placement inside relevant conversations Engagement loops to warm up your account Community building before the token launch Targeted replies to potential holders Natural follower and engagement growthThis strategy gives your project:Visibility Hype Social proof Community trust Algorithm recognition A stronger TGE launchAnd unlike spammy reply services, this is carefully curated, personalized, and executed manually.Why I Only Work With 6 Projects Per Month Because real engagement takes:Time Positioning Research Immersive commenting Community immersion ConsistencyI refuse to mass service dozens of clients because that dilutes quality. I only take 6 clients per month, so each project gets real attention and real results.Get Started Now If you’re a token founder preparing for a launch, and you want:Real algorithmic traction Community growth More engagement Pre TGE hype Visibility on X A stronger, more confident token launchThen now is the time to warm up your social graph — not after you launch. See pricing and apply here:https://replyguy.carrd.co Slots are limited to 6 per month, and I only work with founders serious about growing their project the right way. I don't do buying followers, or paying kols, to promote as that is only for pump and dump projects. Those pumps last only for a few hours the kills the project thereafter.

The Ultimate Beginner’s Guide to Providing Liquidity on Uniswap V3

The Ultimate Beginner’s Guide to Providing Liquidity on Uniswap V3 If you’ve ever wondered how people actually make money in DeFi beyond just buying and holding tokens, liquidity providing on Uniswap V3 is one of the most powerful and widely used strategies in all of decentralized finance. This guide is built for complete beginners but goes deep enough that even intermediate users will walk away with new insights. Let’s turn you into a confident, profitable liquidity provider.Why Provide Liquidity in the First Place? When you trade on Uniswap, someone has to be on the other side of that trade. That “someone” is the collective liquidity in the pool. By depositing your tokens, you become the market maker and earn a percentage of every single trade that happens in your pool — 24 hours a day, 7 days a week, while you sleep. Uniswap V3 (launched May 2021) completely changed the game with concentrated liquidity. Instead of your capital being spread uselessly from price 0 to infinity (like V2), you now decide exactly which price range your money works in. This can give you 50–4000× more capital efficiency than V2, meaning dramatically higher fee yields — but it also introduces new risks we’ll cover in extreme detail.Core Concepts You Must Understand Before Depositing a Single Dollar 1. Liquidity Pool A smart contract that holds reserves of two tokens (e.g., ETH and USDC) and allows anyone to swap between them using the constant-product formula (or concentrated version in V3). 2. Concentrated Liquidity (The Big Innovation) You choose a custom price interval such as $1,800–$2,800 for ETH/USDC. Your capital only earns fees when the market price is inside that interval. The narrower the range, the more fees you earn per dollar when in-range — but the higher the chance you go out-of-range and earn nothing. 3. Fee Tiers Uniswap V3 offers four tiers per pool:0.01 % → stablecoin & pegged assets 0.05 % → tightly correlated pairs (e.g., stETH/ETH) 0.30 % → standard volatile pairs (ETH/USDC, BTC/ETH) 1.00 % → exotic or extremely volatile pairsHigher fee tier = more fees per trade, but usually lower trading volume. 4. Impermanent Loss (Explained Below in Exhaustive Detail) 5. Total Value Locked (TVL) & Volume Always check DefiLlama or the Uniswap Info page. Higher TVL + high 24h volume = safer and more profitable.Impermanent Loss: The Most Misunderstood Risk in DeFi Impermanent loss (IL) is the difference in value between:Holding the tokens outside the pool, vs Depositing them into the pool and withdrawing later when prices have changedWhy Does It Happen? Uniswap pools must always maintain roughly 50/50 value of both tokens. When the external price of one token rises, arbitrageurs buy the cheaper token from the pool until the ratio rebalances. This forces you to sell the appreciating token at a discount and buy more of the depreciating one — exactly the opposite of what you want. Exact Impermanent Loss Formula (for full-range positions ≈ Uniswap V2/V3 full-range) Real-World Impermanent Loss TablePrice Change (Token A vs Token B) Impermanent Loss±10 % 0.3 %±25 % 0.6 %±50 % 2.0 %±100 % (2×) 5.7 %±300 % (4×) 13.4 %±500 % (6×) 18.5 %±900 % (10×) 25.5 %In concentrated liquidity the story is very different:If price stays inside your range → IL is actually lower than full-range If price leaves your range → you can suffer near-100 % loss of the winning token (minus fees earned)Example Walk-through (Numbers Every Beginner Should Memorize) You deposit $10,000 → $5k ETH + $5k USDC when ETH = $2,000Later ETH pumps to $4,000 (2×) If you had just held→ $5k ETH becomes $10k + $5k USDC = $15,000 → +50 % If you provided full-range liquidity→ Pool forces you to sell half your ETH gains→ You end up with ≈ $14,142 → only +41.42 %→ You suffered 5.7 % impermanent loss vs holding Now imagine you chose a narrow range $1,900–$2,100. When ETH hits $4,000 your position becomes 100 % USDC — you missed the entire rally. That’s the trade-off.Proven Strategies to Minimize or Completely Avoid Impermanent LossStrategy IL Exposure Typical APR Difficulty Best ForStablecoin pairs (USDC/USDT/DAI 0.01 %) Near zero 2–20 % ★☆☆☆☆ Absolute beginners, parking cashstETH/ETH or cbETH/ETH 0.05 % Extremely low 4–25 % ★★☆☆☆ ETH bulls wanting yieldFull-range major pairs (ETH/USDC 0.3 %) Same as V2 8–30 % ★★☆☆☆ Long-term HODLersWide active range (±40–60 % around price) Moderate 20–100 % ★★★☆☆ Balanced approachMedium range (±15–30 %) High when wrong 50–300 %+ ★★★★☆ Experienced, actively monitoredNarrow range market making Very high 100–1000 %+ ★★★★★ Professional LPsSingle-sided liquidity (via vaults) Zero Half fees ★★☆☆☆ Strongly directional viewHedged LP (LP + short/long perps) Can be near zero Fees – funding ★★★★★ Advanced usersMost Popular Beginner Strategies in 2025USDC/USDT 0.01 % on Base or ArbitrumAlmost zero IL, 5–15 % real yield from organic volume, gas < $0.10.Full-range ETH/USDC 0.3 % on Mainnet or ArbitrumIf you planned to hold ETH anyway, you earn 10–40 % extra yield with the same IL as just holding.stETH/ETH 0.05 %You earn staking yield + liquidity fees + tiny IL because the peg rarely breaks.Detailed Step-by-Step Walkthrough (With Screenshots in Mindset)Choose Your Network WiselyEthereum L1 gas is expensive. Start on Arbitrum, Optimism, Base, Polygon, or zkSync Era.Go to app.uniswap.orgClick “Connect Wallet” → MetaMask/Rabbit/WalletConnect.Navigate to Pool tab → “New Position”Select Token PairType or choose (e.g., ETH and USDC). Always double-check contract addresses on volatile tokens.Choose Fee TierUniswap shows recommended tier — follow it unless you have a strong reason not to.Set Your Price Range Beginners: click “Full Range” Intermediate: use the preset buttons (Narrow, Common, Wide) Advanced: manually drag or type exact pricesPro move: look at 90-day price history on DexScreener or Coingecko and set range to cover most of that period.Deposit AmountYou can deposit uneven amounts — Uniswap auto-calculates how much of the second token is needed.Approve TokensFirst transaction approves spending (one-time per token). Second transaction creates the position.Confirm & WaitPosition appears under “Your Positions”.MonitorUse Uniswap Info, DeFiLlama, or tools like Zapper, Zerion, or Apespace to track fees earned.Tools Every Serious Liquidity Provider Uses in 2025Tool PurposeDefiLlama TVL & volume across all poolsinfo.uniswap.org Official analyticsDexScreener Real-time charts & range suggestionsGamma Strategies Auto-rebalancing vaultsArrakis Finance Advanced single-sided concentrated liquidityRevert Finance Visual impermanent loss simulatorTenderly / Etherscan Simulate transactions before sendingReal-World Example: $10,000 Position Walkthrough Let’s say ETH is $3,300 today. You decide on ETH/USDC 0.3 % fee tier, range $2,500–$4,500 (±36 %). You deposit $10k → ~1.52 ETH + ~$5,000 USDC. Over the next 6 months:Pool earns $1,200 in fees Price stays mostly inside your range You suffer only ~2–3 % IL because range was wide → Net return ≈ +9–10 % (much better than just holding)If you had chosen a narrow $3,200–$3,400 range:Fees could have been $4,000+ But if ETH went to $4,200 → you’d be 100 % USDC and missed the rallyChoose your risk level consciously.Advanced Topics Worth KnowingTick spacing: each fee tier has minimum tick distance (prevents spam) Range orders: using concentrated liquidity as a limit order Fee compounding: harvesting reinvesting fees dramatically increases long-term APY Liquidity mining programs: some pools have extra token rewards (check GeckoTerminal)Final Checklist Before You Deposit Have I chosen a high-volume pool?Is my range reasonable for my time horizon?Am I on a low-fee L2?Do I have a plan if price moves 50 %+?Am I comfortable losing some value to IL in exchange for fee income? If yes to all → go for it.Conclusion: Your Path to Becoming a Profitable LP Uniswap V3 turned liquidity providing from a passive, mediocre-yield activity into one of the highest-return strategies in crypto — when done correctly. Start simple: Do your first position in a stablecoin pool on Base or Arbitrum Graduate to full-range ETH/USDC Experiment with wider active ranges Eventually try managed vaults or narrow ranges once you truly understand the mechanicsRemember the golden rule:“The best liquidity providers are the ones whose price range contains the market price for the longest possible time.”Master that, and you’ll be printing fees while everyone else is just hoping for the next 100× meme coin. Now go add some liquidity — the pools need you. Happy yielding!

Preparing for the Polymarket Airdrop: A Step-by-Step Guide (2025–2026)

Preparing for the Polymarket Airdrop: A Step-by-Step Guide (2025–2026) Polymarket, the leading decentralized prediction market platform on Polygon, has confirmed plans to launch its native token $POLY with an associated airdrop for active users. This follows their recent U.S. relaunch preparations and a $2 billion funding round at a $9 billion valuation, positioning it as one of the most anticipated drops in crypto history potentially rivaling Uniswap’s $6.4 billion distribution in scale. The exact timeline points to Q1 2026, tied to full U.S. operations via their CFTC regulated exchange acquisition, but eligibility will likely be snapshotted based on pre-launch activity. No official criteria have been released yet, but based on Polymarket’s points system (gPOLY) and patterns from similar projects (e.g., Arbitrum, Optimism), rewards will prioritize genuine engagement over sybil farming. The key? Start now trading volume and consistency are your best bets for qualifying, with the top 20% of users potentially seeing the largest allocations. Aim for $100–$200 in total activity to hit basic thresholds, but scale up for better odds. Here’s how to get set up and maximize your chances without risking capital unnecessarily. 1. Set Up Your Account and WalletSign up on polymarket.com → create an account using email or social login (no KYC for most regions; U.S. beta live via QCX). Connect a Polygon-compatible wallet (MetaMask, Bitget Wallet, etc.). Your linked wallet will receive the $POLY airdrop. Pro tip: Keep ~$5–10 in MATIC for gas.Deposit USDC on Polygon ($50–$100 is plenty to start) via Polygon Bridge, Coinbase, or any major exchange.2. Build Activity Through TradingPlace real bets on Yes/No outcomes (elections, sports, crypto prices, pop culture). Even $10 trades count. gPOLY points are based on volume, trade count, and consistency. Higher volume ($500+) + weekly activity = higher rank. Track your stats: Search “Polymarket Trader Leaderboard” on Dune Analytics and paste your wallet address. Smart strategy: Bet on topics you actually understand, diversify across 5–10 markets, and never wash trade (Polymarket detects and disqualifies it).Only ~1.7% of users have traded >$50K — consistent $200–$1K volume already puts you in a strong mid-tier cohort. 3. Earn Community Badges & Extra VisibilityPost trade recaps, analysis, or strategies on X and tag @Polymarket many contributors have earned special badges that may boost allocations. Grow your audience by sharing real insights (users like @Graciee0x gained traction this way). Stay active in Discord and watch for referral campaigns or bonus tasks.4. Monitor Progress & Stay ReadyUse trackers like CryptoRank, DappRadar, or community dashboards to log tasks. Snapshot can happen anytime after full U.S. relaunch — stay glued to @Polymarket on X. Current market odds on Polymarket itself: “$POLY launch by Q1 2026” sits at ~67% (late Nov 2025).Risk note: Only bet money you can afford to lose. Wrong predictions = $0 per share; correct ones = $1. Potential Rewards & Final CaveatsA 10% TGE airdrop at $10B FDV = ~$1B total value distributed. Top traders could see 5–10x the base allocation. This is retroactive — farm ethically or risk blacklisting.Start trading smart today and you’re not just farming $POLY you’re actually profiting from the world’s most accurate prediction engine (Polymarket’s crowd beats traditional polls 70%+ of the time). DYOR and good luck! Details subject to change — always verify on Polymarket’s official channels.

How to Use NordVPN with Hyperliquid - Step by step guide

How to Use NordVPN with Hyperliquid – The Exact 5-Minute Setup I Run Before Every Perps Trade in 2025 I trade Hyperliquid full-time.I never open a position without first connecting to NordVPN. Hyperliquid is the fastest-growing on-chain perps venue on Arbitrum right now — 50x leverage, sub-second execution, zero gas on trades — but if you’re connecting with your raw home IP in late 2025, you’re getting throttled, geo-blocked in some regions, and leaking your location to anyone watching. This 5-minute routine fixes all of that forever. Why Hyperliquid Traders Need a VPN (It’s Literally Required in Some Places)Hyperliquid logs your real IP (even though it’s non-KYC) ISPs throttle WebSocket traffic → +200–500 ms latency spikes during pumps Certain countries / networks block Hyperliquid front-ends or Arbitrum RPCs outright Public WiFi + hot wallet = instant drain risk NordVPN = AES-256 encryption, audited no-logs, 8,400+ servers in 126 countries, true kill switch, Threat Protection ProLet’s lock it down. My Exact 5-Minute NordVPN → Hyperliquid Setup 1. Grab the Deal (60 seconds) → Get NordVPN with the current promo (3–4 months free)(Disclosure: affiliate link — using it keeps the blog free and gets you the lowest price) Take the 2-year plan — right now it’s usually ~$3.09–$3.99/month + 3–4 months free. 2. Install the App Download straight from your Nord account after payment — works on Windows, Mac, iOS, Android, and browser extensions. 3. Enable the Non-Negotiable Settings (15 seconds) Open NordVPN → Settings → turn ON:Kill Switch (system-level — kills internet if VPN drops) Threat Protection Pro (blocks phishing sites trying to steal your MetaMask seed) Auto-connect on startup4. Connect to the Fastest Hyperliquid-Optimized Server These are my personally tested servers (Nov 2025) — Hyperliquid runs on Arbitrum, so low-latency to US/EU is king:Your Region Best NordVPN Server Avg Ping to Hyperliquid NotesAsia / Australia Singapore #1000–#1200 45–55 ms Solid for ETH perps during Asia hoursEurope Frankfurt #800–#900 35–42 ms Lowest slippage on BTC/ETH pairsUnited States New York #600–#700 28–35 ms Best overall speed & liquidityRestricted Country Obfuscated Servers (any) +10 ms Hides that you’re using a VPNPro tip: Add a Dedicated IP (~$5/mo extra) if you hate “new location” warnings on exchanges. 5. Test & Start TradingVisit whatismyipaddress.com — should show your VPN server Open app.hyperliquid.xyz → connect MetaMask → place a tiny test position Watch the latency in the Hyperliquid UI — should stay under 50 ms even during chaosYou’re now completely invisible and untouchable. Bonus Stack for Maximum SecurityNordVPN (this guide) Ledger or Trezor hardware wallet MetaMask + hardware wallet integration Koinly for taxesDo this once and you’ll never trade naked again. Drop a comment if you want the same guide for Drift, Aster, GMX, or Bybit — already got them ready. Stay safe out there. — Nefu (@txchyon)txchyon.com (When you’re ready to grab NordVPN, use my link again — it’s the cheapest you’ll ever see it and keeps these guides coming.)

How to setup Drift.trade with VPN – The Exact 5-Minute Setup I Run Before Every Perps Trade in 2025

How to Use NordVPN with Drift.trade – The Exact 5-Minute Setup I Run Before Every Perps Trade in 2025 I trade Drift full-time.I never open a position without first connecting to NordVPN. If you’re still hitting app.drift.trade with your raw home IP in late 2025, you’re leaking your location, getting throttled by your ISP during pumps, and making yourself an easy target on public WiFi. This 5-minute routine fixes all of that — forever. Why Drift Traders Need a VPN (No Cap)Drift logs your real IP (even though it’s on-chain) ISPs throttle WebSocket-heavy traffic → +200–500 ms latency spikes exactly when you need speed Certain countries / networks quietly block Drift, Phantom, or Solana RPCs Public WiFi + hot wallet = instant drain risk NordVPN = AES-256 encryption, audited no-logs, 7,200+ servers in 118 countries, true kill switch, Threat Protection ProLet’s lock it down. My Exact 5-Minute NordVPN → Drift Setup 1. Grab the Deal (60 seconds) → Get NordVPN with the current promo (3–4 months free)(Disclosure: affiliate link — using it keeps the blog free and gets you the lowest price) Take the 2-year plan — righhttps://refer-nordvpn.com/emkOgYiYuRSt now it’s usually ~$3.09–$3.99/month + 3–4 months free. 2. Install the App Download straight from your Nord account after payment — works on Windows, Mac, iOS, Android, and browser extensions. 3. Enable the Non-Negotiable Settings (15 seconds) Open NordVPN → Settings → turn ON:Kill Switch (system-level — kills internet if VPN drops) Threat Protection Pro (blocks phishing sites trying to steal your Phantom seed) Auto-connect on startup4. Connect to the Fastest Drift-Optimized Server These are my personally tested servers (Nov 2025):Your Region Best NordVPN Server Avg Ping to Drift NotesAsia / Australia Singapore #1000–#1200 38–45 ms Best for SOL memecoin perpsEurope Frankfurt #800–#900 42–48 ms Lowest slippage on BTC/ETH pairsUnited States New York #600–#700 44–52 ms Great for US session liquidityRestricted Country Obfuscated Servers (any) +10 ms Hides that you’re using a VPNPro tip: Add a Dedicated IP (~$5/mo extra) if you don’t want exchanges flagging “new location” logins every day. 5. Test & Start TradingVisit whatismyipaddress.com — should show your VPN server, not your real IP Open app.drift.trade → connect Phantom → place a tiny test position Watch the latency in the bottom-right of Drift — should stay under 60 ms even during pumpsYou’re now completely shielded. Bonus Stack for Maximum SecurityNordVPN (this guide) Ledger or Trezor hardware wallet Phantom with approval delays turned on Koinly for taxes (so you never have to KYC a CEX again)Do this once and you’ll never trade naked again. Drop a comment if you want the same guide for Hyperliquid, Aster, or GMX — already got them queued. Stay safe out there. — Nefu (@txchyon)txchyon.com (When you’re ready to grab NordVPN, use my link again — it’s the cheapest you’ll ever see it and keeps these guides coming.)

$VOOI TGE in Days: Full Research + Playbook

$VOOI TGE in Days: Full Research + Playbook The $VOOI token generation event is literally days away (most likely December 1st, 2025), and the numbers are stupid.Community sale target: $500K Actual pledges: $13M → 26× oversubscribed in 4 days Cumulative trading volume on the platform: $20B+ Current daily volume: $200-400M (real users, not wash) Pre-market price on Whales Market: ~$0.75 (implying 1.5-3× from $112.5M launch FDV)This isn’t another narrative coin. This is the Robinhood of on-chain perps that already works, already has product-market fit, and is about to drop a token that actually does something. Here’s the full research + exact playbook before TGE. 1. What the Hell Is VOOI? VOOI is a non-custodial, chain-abstracted trading super-app that lets you long/short anything — crypto, stocks, forex, RWAs — from a single unified balance with zero bridges, zero gas, and CEX-level speed. Think 1inch but for perps + spot + RWAs, with an AI copilot and 1-click gasless trades. Key magic:One collateral pool across Ethereum, Arbitrum, Base, Solana, Hyperliquid, etc. Intent-based routing to the best venue (Aster, Hyperliquid, Gains, Orderly, Lighter, etc.) Up to 1000× leverage on real-world assets Fully self-custodial — VOOI never touches your fundsResult? Retail traders finally get a DeFi experience that doesn’t make them want to quit crypto. 2. Traction That Can’t Be FakedMetric Number (Nov 25, 2025) ContextCumulative Volume $20B+ More than Aster had pre-TGEDaily Volume $200-400M Top 5 perp DEXs on most daysActive Traders 130K+ Real retail, not botsMarkets Supported 200+ (perps, spot, RWAs) Mag7 stocks, gold, forex, game assetsPoints Distributed 20M+ (Epoch 19 live) 20% of total supply reserved for tradersThis volume existed before any token incentives. That’s the definition of organic PMF. 3. $VOOI Tokenomics — Actually Fair (For Once)Total Supply: ~100M (inferred from $112.5M FDV at $1.125 price) Launch FDV: $112.5M Community Sale + Airdrop: 20% fully unlocked at TGE Ecosystem/Points Pool: 20% emitted over 12 months based on real trading Liquidity at TGE: 15% → deep order books from day 1 Team & Early Backers: Locked (6-24 months)Utility that actually matters:Stake $VOOI → up to 50% fee discounts Stake $VOOI → boosted points multiplier Governance + premium features (multi-account, advanced AI)Protocol fees (0.02-0.05%) will flow into buybacks + staking rewards → real yield, not inflationary garbage. 4. The 26× Oversubscribed Sale — What It Actually Means Cookie Launchpad (via Legion) sale:$500K target $13M pledged in 4 days 4,982 participants 75% public pool filled in minutesThis wasn’t VC dumping. This was thousands of actual traders and Cookie Snappers fighting for allocation. Pre-market OTC on Whales Market is already trading ~$0.75 with climbing bids. Polymarket odds:94% chance market cap >$10M Day 1 92% chance $1B+ FDV narrative sticks5. Exact Playbook Before & After TGE Right Now (You Have ~48-72 Hours):Link everything for airdrop → https://app.vooi.io/apply-for-claim(EVM wallet + X + Telegram/Discord — snapshot was Nov 13) Farm Epoch 19 points (ends ~Dec 1)→ Trade minimum $10K on Light/Pro venues + $500 cross-chain for max multiplier→ Paper trade on Telegram Mini-App for extra VT points Stake $COOKIE if you have it → extra allocation boost Watch Whales Market for pre-market dip (current ~$0.75)Post-TGE:Claim airdrop (8-day window) Stake immediately for fee discounts + yield Watch Korean exchange listings (Upbit rumors strong)6. Price Targets & ThesisLaunch FDV: $112.5M (already priced in) Realistic 30-90 day target: $500M – $1B (volume flywheel + Korean retail) 2026 bull case: $2-3B+ (if perps season returns and V3 RWA expansion ships)Comparables:Aster launched → $10B FDV peak Hyperliquid at $15B+ FDV today VOOI has better UX and broader asset coverageAt $112.5M FDV with real revenue and real users, this is one of the cleanest risk/reward setups of the cycle. Final Words Most launches are noise.$VOOI is signal. If you’ve ever rage-quit a trade because of bridging, chain switching, or gas — this platform was built for you. And now it has a token that rewards you for using it. I’m farming points hard, claiming the airdrop, and buying the TGE dip. See you on the other side. Trade safe, size responsibly, and I’ll see you at $1B. — NefuFollow @nefutrades for more alpha drops.