-

Nefu

Nefu - 01 Jan 2026

- Research analysis

On-Chain Due Diligence: What Wallet Activity Reveals Before Price Moves

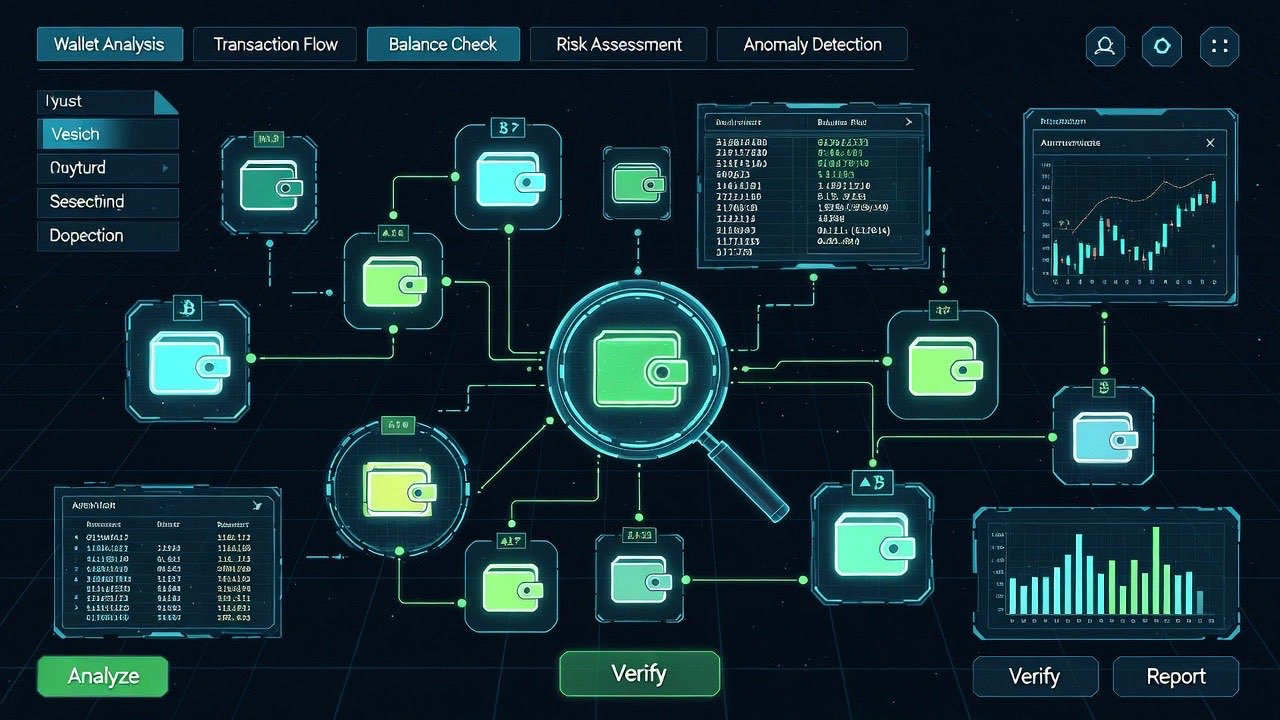

Introduction: Why Wallet Analysis Matters In crypto, on-chain data is the truth. Marketing, social media hype, and project announcements are often misleading. Wallet activity provides real insight into investor sentiment, distribution, and potential market moves. This guide is part of the Due Diligence Framework cluster, complementing:The Ultimate Crypto Due Diligence FrameworkHow to Perform Due Diligence on a Crypto Project in Under 60 MinutesRed Flags That Kill Crypto Investments By the end of this article, you’ll understand how to read wallet data to make smarter investment decisions.Step 1: Identify Key Wallets Focus on the wallets that matter most:Founders & Team Wallets: Can signal selling pressure or commitment. Investor/VC Wallets: Often have lockups; large movements matter. Whale Wallets: Can move markets; track accumulation and distribution. Exchange Wallets: Deposits often precede selling; withdrawals may signal accumulation.Tools for tracking:Etherscan / BSCScan / Solscan Nansen / Dune / Glassnode dashboards Whale Alert for large transactionsStep 2: Monitor Wallet Concentration Wallet concentration provides insight into risk and distribution:High Concentration: Few wallets hold most tokens → higher risk of dump Low Concentration: Distributed holdings → stronger stabilityCheck token holders list to see the top 10–20 wallets and their percentage holdings.Step 3: Track Large Transfers and Whale Movements Large wallet movements can signal:Impending sell pressure Strategic accumulation Coordination among investors or teamsLook for:Transfers from private wallets to exchanges (potential selling) Exchange withdrawals (accumulation by whales) Recurrent patterns in token transfersStep 4: Evaluate Liquidity and DEX Activity Liquidity tells you how easily a token can be bought or sold:Track liquidity pools and depth Observe sudden inflows/outflows Watch for pool manipulation or sudden withdrawal of liquidityDecentralized exchanges are public; activity here can reveal investor behavior before price moves.Step 5: Assess Active Users vs Holders Usage signals adoption:Compare number of active wallets to total holders Assess whether activity is growing organically Track repetitive addresses to identify bots or farming schemesStrong on-chain usage indicates real product-market fit and long-term potential.Step 6: Integrate On-Chain Findings into Decision-Making Combine insights from wallet concentration, whale movements, liquidity, and active user metrics with your broader due diligence framework:Tokenomics analysis: Are whales aligned with community incentives? Team credibility: Are team wallets selling or holding? Red flags: Large dumps, opaque wallets, suspicious patternsFor a practical summary and structured approach, see:The Crypto Due Diligence ChecklistStep 7: Tools and Automation Efficient tracking requires the right tools:Dashboards: Nansen, Dune, Glassnode Alerts: Whale Alert, Telegram bots, custom scripts Explorers: Etherscan, Solscan, BSCScan for wallet-specific queriesAutomation helps monitor dozens of wallets without manual effort, especially for fast-moving tokens.Step 8: Practical ExampleIdentify top 5 investor wallets Track transfers to exchanges over 7 days Compare inflows/outflows to total liquidity Note wallet concentration changes Adjust investment thesis accordinglyThis method highlights potential selling pressure and accumulation trends before the market reacts.Conclusion On-chain wallet analysis turns transparency into an actionable advantage. By monitoring wallets, liquidity, and user activity, investors can identify red flags, evaluate tokenomics alignment, and anticipate market movements. Integrate this approach with your broader due diligence process for maximum insight: Ultimate Crypto Due Diligence Framework 60-Minute Crypto Due Diligence Red Flags That Kill Crypto Investments Crypto Due Diligence ChecklistWith consistent application, wallet analysis becomes a core part of informed crypto investing.

-

Nefu

Nefu - 01 Jan 2026

- Research analysis

The Ultimate Crypto Due Diligence Framework (Step-by-Step)

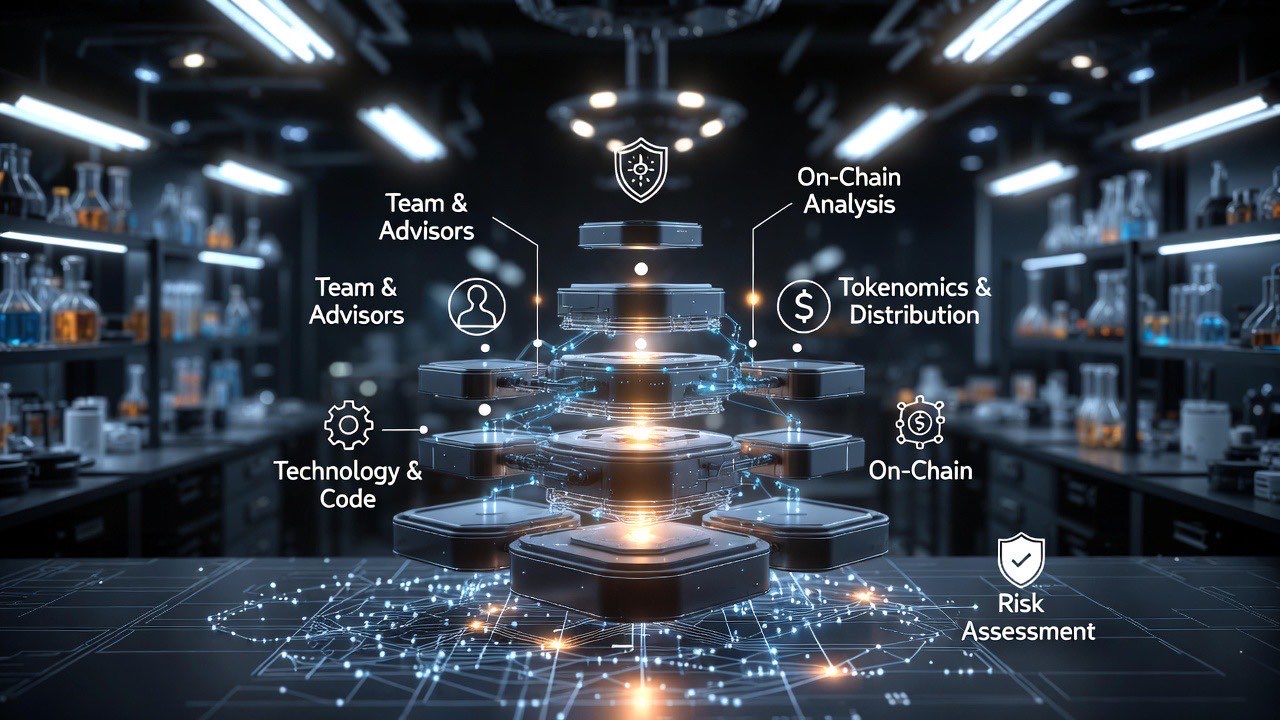

Introduction: Why Due Diligence Matters in Crypto Crypto markets reward speed, conviction, and timing—but they punish lazy research. Unlike traditional markets, crypto projects often launch with minimal disclosures, anonymous teams, rapidly changing roadmaps, and token structures designed more for speculation than sustainability. This is why a repeatable due diligence framework matters. Due diligence does not eliminate risk. Instead, it helps you avoid unnecessary risk—projects with weak fundamentals, misaligned incentives, or structural flaws that eventually surface regardless of market conditions. This guide presents a step-by-step crypto due diligence framework that can be applied to any token, protocol, or blockchain project. It is designed to be:Modular Time-efficient Evergreen Usable for both long-term investors and active tradersLater articles in this cluster expand on individual components, including a compressed version for speed and deeper on-chain analysis techniques.Step 1: Define the Investment Context Before analyzing a project, clarify why you are evaluating it. Context determines how much depth is required and which risks matter most. Ask yourself:Is this a long-term investment or a short-term trade? Are you investing based on fundamentals, narratives, or momentum? What is your time horizon? How large will the position be relative to your portfolio?A project suitable for a short-term momentum trade may be entirely unsuitable for a long-term hold. Due diligence begins by aligning expectations with reality.Step 2: Identify the Problem and Value Proposition Every legitimate crypto project attempts to solve a problem. Your task is to determine whether:The problem actually exists Blockchain technology is necessary The solution is meaningfully differentiatedKey questions:Who is the target user? What pain point does the project address? Why is a token required? What happens if the project fails to gain adoption?If the value proposition cannot be explained clearly in one or two sentences, that is an early warning sign.Step 3: Evaluate the Tokenomics Tokenomics define how value flows through a system. Poor token design can destroy otherwise strong products. Key areas to analyze: Supply StructureTotal supply vs circulating supply Inflation rate and emission schedule Maximum supply constraintsDistributionTeam allocation Investor and advisor allocations Community and ecosystem incentivesVesting and UnlocksCliff periods Linear vs lump-sum unlocks Known unlock dates and sizesMisaligned tokenomics often lead to sustained sell pressure, especially during unlock events. This is a common cause of long-term underperformance. For a deeper breakdown of time-efficient token analysis, seeHow to Perform Due Diligence on a Crypto Project in Under 60 MinutesStep 4: Analyze the Team and Governance Crypto projects are built by people. Assessing the team helps determine whether a project can execute. Evaluate:Founder background and experience Prior startups or protocol involvement Public presence and accountability GitHub activity and contribution historyAnonymous teams are not automatically disqualifying, but they increase execution and trust risk. Transparency, even without full doxxing, matters. Governance considerations include:Who controls protocol upgrades? How decentralized decision-making is Whether token holders have real influenceStep 5: Assess On-Chain Activity On-chain data reveals behavior that marketing cannot hide. This is one of crypto’s biggest advantages over traditional markets. Key signals include:Wallet concentration Whale accumulation or distribution Developer wallet activity Liquidity depth and movementUnusual wallet behavior often precedes major price moves. A full walkthrough of these techniques is covered inOn-Chain Due Diligence: What Wallet Activity Reveals Before Price MovesStep 6: Evaluate Product and Market Fit Adoption matters more than narratives. Assess whether the project shows signs of real usage:Active wallets Transaction volume quality User retention Organic growth vs incentivesAsk:Are users paying to use the product? Does usage persist when incentives decline? Is growth sustainable?Speculative demand alone does not equal product-market fit.Step 7: Competitive Landscape Analysis No crypto project exists in isolation. Analyze:Direct competitors Alternative solutions Barriers to entry Network effects or switching costsA strong project either:Does something meaningfully better, or Does something meaningfully cheaper, or Has a defensible nicheIf competitors can replicate the product easily, long-term value capture becomes difficult.Step 8: Risk Assessment Every investment carries risk. Due diligence makes risk visible. Common crypto risks include:Smart contract vulnerabilities Regulatory uncertainty Token dilution Centralization of control Liquidity riskA structured risk review helps you decide whether potential upside justifies exposure. Many investors skip this step entirely, which is why losses often feel “unexpected” in hindsight.Step 9: Identify Red Flags Early Some warning signs justify walking away immediately. Examples include:Unrealistic yield promises Constant roadmap changes Opaque token distributions Heavy insider selling Aggressive marketing without substanceA full list of high-signal warnings is covered inRed Flags That Kill Crypto Investments (Before You Lose Money)Step 10: Synthesize and Decide The final step is synthesis. Ask:What is the strongest argument for this investment? What is the strongest argument against it? What would invalidate your thesis?If you cannot clearly articulate both sides, more research is needed. Position sizing matters as much as conviction. Even strong projects can fail.Using This Framework Efficiently Not every investment requires full-depth analysis. This framework is designed to scale.Long-term holds: run all steps Medium-term positions: focus on tokenomics, team, and on-chain data Short-term trades: prioritize liquidity, wallet behavior, and catalystsFor a compressed workflow, seeHow to Perform Due Diligence on a Crypto Project in Under 60 MinutesFinal Thoughts Crypto due diligence is not about predicting the future. It is about avoiding preventable mistakes and improving decision quality over time. A disciplined framework turns randomness into probability and speculation into informed risk-taking. For a practical, printable version of this process, refer toThe Crypto Due Diligence Checklist Used consistently, this framework becomes a competitive advantage.

-

Nefu

Nefu - 31 Dec 2025

- Prediction markets

How to Earn Passive Yield as a Liquidity Provider on Prediction Markets

How to Earn Passive Yield as a Liquidity Provider on Prediction Markets While most traders chase volatile price swings, a steady stream of income flows to liquidity providers—the essential backbone of every prediction market. By supplying the capital that enables smooth trading, you can earn consistent yield from fees and incentives. This guide breaks down exactly how to become a liquidity provider across the top prediction platforms, comparing their rewards, risks, and the step-by-step processes you need to get started.Understanding Prediction Market Liquidity At its core, providing liquidity means you're making it easier for others to trade. Platforms reward this service in two main ways: 1. Automated Market Makers (AMMs - Worm.wtf, Polymarket Pools) You deposit a balanced pair of assets (like "Yes" and "No" shares) into a smart contract pool. This pool automatically facilitates trades, and you earn a percentage of every fee. 2. Order Books (Kalshi, Augur) You place "resting" limit orders (bids to buy and asks to sell) on a traditional order book. You earn from the spread between prices or through specific incentive programs for market makers. The best platform for you depends on whether you prefer the automated, permissionless nature of DeFi or the structured programs of regulated platforms.Platform Breakdown: Where to Provide Liquidity 🦄 Polymarket (Hybrid Model) Polymarket combines an order book with AMM pools for high-volume markets. Its liquidity programs are often invite-only for major events, offering a share of trading fees plus bonus rewards.Best For: Patient capital seeking institutional-grade volume. Current Opportunity: Fee-sharing pools around major geopolitical or crypto events. Getting Started: You can join the platform via this link and monitor their official channels for program announcements.🐛 Worm.wtf (Bonding Curve AMM) Built on Solana, Worm.wtf uses bonding curves where early liquidity providers can get in at lower prices. Rewards come from creator-set fees on trades.Best For: Agile capital chasing higher APYs on trending, viral markets. Current Opportunity: Pre-sales and early bonding curve phases for crypto/political topics. Learn More: What Is Worm.wtf? The Complete Beginner's Guide📊 Kalshi (Regulated Order Book) As a CFTC-regulated U.S. platform, Kalshi runs a traditional order book. It incentivizes liquidity through a transparent Liquidity Incentive Program (running through Sep 2026) and an elite Market Maker program.Best For: U.S.-based participants wanting a regulated environment with clear daily rewards. Current Opportunity: Daily incentive programs in major politics and economics markets. Learn More: What Is Kalshi? The Complete Beginner's Guide🔮 Augur (Decentralized Order Book) The pioneer of decentralized prediction markets, Augur relies on a peer-to-peer order book. Providing liquidity is more manual, involving creating and posting your own bids and asks.Best For: Decentralization purists and those trading in niche markets. Current Opportunity: Manual market making in less-competitive, long-tail markets. Learn More: What Is Augur? The Complete Beginner's GuideRisk Assessment: What Could Go Wrong? Providing liquidity isn't free money. Here are the key risks:Impermanent Loss (AMMs): The value of your pooled assets can decrease compared to simply holding them if prices diverge significantly. Low Volume / Capital Erosion: In an illiquid market, your capital sits idle, earning minimal or no fees while still being at risk. Platform & Smart Contract Risk: Bugs in a protocol's code or sudden regulatory changes can lead to loss of funds.🛡️ Mitigation Strategy: Start small, stick to high-volume markets on reputable platforms, and never allocate capital you can't afford to lock up.Step-by-Step Action Plans Providing Liquidity on Worm.wtfConnect a Solana wallet (Phantom, Backpack). Navigate to a market in "Pre-Sale" or with an active bonding curve. Deposit USDC—it's automatically converted into a balanced position on the curve. Earn a proportional share of all trading fees. Exit at any time by withdrawing your share from the pool.Providing Liquidity on KalshiSign Up & Verify: Complete KYC at kalshi.com. Fund Account: Deposit minimum $1. Place Limit Orders: To add a Bid: Set a "Buy Yes/No" Limit price below the current ask. To add an Ask: Set a "Sell Yes/No" Limit price above the current bid.Earn Rewards: Eligible resting orders automatically qualify for the daily Liquidity Incentive Program payouts.Providing Liquidity on PolymarketGet Access: Join the platform to get on the radar for programs. Watch for Drops: Monitor Polymarket's Discord and X for liquidity pool announcements. Deposit & Earn: If selected, deposit USDC into the specified AMM pool to begin earning fee shares and potential bonus tokens.Providing Liquidity on AugurUse the Augur interface or a compatible dApp (like Matcha). For a chosen market, manually create and post both "Yes" and "No" limit orders to create a two-sided market. Earn the spread when your orders are filled by other traders.Who Should (and Shouldn't) Provide Liquidity? ✅ You're a good fit if you...Have at least a mid-four-figure portfolio to allocate. Are comfortable with intermediate DeFi concepts. Value consistent yield over home-run trades. Have the patience to monitor and manage positions.❌ You might want to wait if you...Are a complete beginner to crypto (master wallets and basic swaps first). Have a small portfolio where gas/transaction fees would eat your profits. Need immediate access to your capital. Are purely seeking short-term, speculative gains.Final Verdict: Your Quick Start PathStart Small & Learn: Begin with a Worm.wtf pre-sale using a small amount to understand bonding curves. Scale with Structure: Move larger, patient capital into a Polymarket or Kalshi incentive program for more reliable, volume-based yield. Specialize: Use Augur for specific, niche markets where you have an edge.Liquidity providing in prediction markets offers one of the more compelling risk-adjusted yields in crypto today—but only for those who understand and respect the unique risks involved.Ready to go deeper? Explore our full suite of guides in the Prediction Markets category.

-

Nefu

Nefu - 31 Dec 2025

- Prediction markets

Prediction Market Arbitrage Guide: How to Find & Execute Risk-Free Profits Across Platforms

Prediction Market Arbitrage Guide: How to Find & Execute Risk-Free Profits Across Platforms Arbitrage is the closest thing to free money left in markets. When the same event trades at different probabilities across platforms, you lock in profit regardless of outcome. No crystal ball required, just speed and attention. Opportunities appear constantly between regulated Kalshi, crypto-native Polymarket, fast-moving Worm.wtf, and niche players. The trick is spotting them before bots or sharp traders close the gap. Types of Arbitrage Available Pure cross-platform: same exact question, different prices. Example: "Will Trump win 2028 nomination?" at 65 percent on Polymarket but 70 percent on Kalshi. Buy Yes cheap, sell expensive, hedge perfectly. Correlated event arb: closely related outcomes mispriced. Example: state-level election markets implying different national popular vote than direct markets. Resolution difference arb: markets resolving on slightly different sources or timing. Tools You Need Free: Manifold dashboards, Prediction Market Aggregator sites, Discord bots pinging discrepancies. Paid: Custom scripts watching APIs (Polymarket and Kalshi expose public endpoints). Worm.wtf moves fastest, so Telegram channels and X alerts help. Live Execution Example Kalshi lists "NFL team to win Super Bowl" at different implied odds than Polymarket futures. If Kalshi Yes on Chiefs costs less than Polymarket equivalent after fees, buy Kalshi Yes, sell Polymarket position. Lock five to ten percent instantly. Election runoffs often diverge twenty points minutes after polls close. Speed wins. Step-by-Step Manual ArbMonitor identical or near-identical markets across platforms. Calculate total cost including fees and slippage. Execute both legs simultaneously (multi-tab life). Hold until resolution or close early if spread tightens.Automated Approaches Simple Python scripts polling APIs work for Polymarket/Kalshi pairs. Worm.wtf requires Solana wallet bots. Start small; exchanges frown on pure arb volume but rarely ban. Risks and Limits Fees eat small edges. Withdrawal delays on some platforms. Resolution disputes affecting only one side (rare but brutal). Liquidity too thin to exit large size. Stick to liquid majors for safety, niche for bigger spreads. Best Current Pairs to Watch US elections aftermath, major sports championships, Bitcoin price milestones, award shows. Worm.wtf niche vs Polymarket mainstream often diverges sharply. Pure arb edges shrink fast as the space matures, but they never fully disappear. Humans remain inefficient. Link up with our platform breakdowns in What Is Kalshi? and What Is Polymarket?. Full arsenal in Prediction Markets.

-

Nefu

Nefu - 31 Dec 2025

- Prediction markets

Prediction Market Bankroll Management: How to Size Positions & Avoid Going Broke

Prediction Market Bankroll Management: How to Size Positions & Avoid Going Broke The fastest way to zero in prediction markets is treating them like a casino. Sharp traders survive decades by obsessing over position sizing more than individual picks. Good edges appear regularly, bad luck streaks do too. Proper bankroll management turns positive expectancy into long-term wealth. Core Rules That Save Accounts Never risk more than one to two percent of total bankroll on a single outcome. High-conviction seventy percent edges still lose thirty percent of the time. One bad run wipes reckless stacks. Separate platforms if possible. Keep Polymarket, Kalshi, and Worm.wtf allocations distinct to avoid correlated blowups. Kelly Criterion Adapted for Yes/No Markets Full Kelly: Bet fraction = (edge / odds). Simplified for prediction markets: Bet bankroll percent = (your probability - market probability) / market probability for Yes (reverse for No). Half-Kelly cuts volatility while preserving most growth. Conservative traders use quarter-Kelly. Example: Market prices event at sixty percent (Yes costs $0.60). You estimate seventy five percent true probability. Half-Kelly says risk roughly twelve percent of bankroll. Leverage Traps on Worm.wtf Leverage magnifies edges and drawdowns. Treat leveraged position sizing as if the full notional amount is at risk. A 3x position should count triple toward your one to two percent rule. Most blowups happen chasing leverage on "sure things." Practical Position Sizing Framework Tier your confidence:Low (55-60 percent): 0.5 percent risk Medium (60-70 percent): 1 percent risk High (70-80 percent): 1.5 percent risk Moonshot (80+ percent): 2 percent maxCap concurrent risk at ten to fifteen percent total exposure. Real Case Studies Trader A risked twenty percent per election market in 2024, nailed ten straight, then lost three crushing ones. Account gone. Trader B stuck to one percent rule, suffered same three losses, barely dented. Compounded gains over years. Tools and Habits Track every trade: entry odds, size, reasoning, outcome. Review monthly. Cut size after three consecutive losses. Increase only after sustained profitability. Bankroll management is boring until it saves your stack. Then it feels genius. Master the platforms first in our guides like What Is Worm.wtf?. Full Prediction Markets category for edges worth protecting.

-

Nefu

Nefu - 31 Dec 2025

- Prediction markets

Prediction Markets Regulation: What’s Legal for Traders in the US, EU, and Global Crypto Platforms

Prediction Markets Regulation: What’s Legal for Traders in the US, EU, and Global Crypto Platforms Regulation decides whether you trade openly or through VPNs and offshore wallets. The landscape shifted dramatically with court rulings, CFTC approvals, and state-level battles. Here is the straight talk on where things stand for major platforms and what it means for your access. United States Kalshi stands alone as fully CFTC-regulated and legal nationwide (state challenges largely defeated). Fiat deposits, KYC, tax reporting, the works. Safest for US persons. Polymarket operates offshore, technically restricted US users via terms of service. Enforcement remains light, many access via VPN/wallet. Risk of future blocks or account freezes exists. Worm.wtf and Augur live fully on-chain, no central entity to regulate. Pure crypto access, but US persons theoretically face commodity trading restrictions. Practical enforcement near zero. European Union MiCA framework classifies many event contracts as financial instruments. Platforms need licenses most lack. EU residents often blocked from Polymarket and Kalshi. Crypto-native options like Worm.wtf remain accessible via wallet. Local regulated alternatives scarce. Rest of World Most jurisdictions treat prediction markets as gambling or unregulated derivatives. Crypto platforms widely available. Some countries (Canada provinces, Australia) impose restrictions similar to US. Key Regulatory Wins and Risks Kalshi court victories cemented event contracts as hedging tools, not gambling. CFTC self-certification speeds new markets. Polymarket paid fines in past, shifted offshore. Future US re-entry possible via partnerships. On-chain protocols like Worm.wtf and Augur sidestep regulation entirely, strength and weakness simultaneously. What It Means for Traders US citizens wanting zero risk: Kalshi only. Everyone else: full menu available, but understand platform terms and local laws. Tax implications differ wildly. Regulated platforms report, crypto ones leave it to you. Future Outlook More regulated entrants likely. Crypto platforms may seek licenses or stay offshore. On-chain pureplays continue for censorship-resistant niche. The space grows fastest where regulation clarifies rather than bans. See platform specifics in our guides to What Is Kalshi?, What Is Polymarket?, and others. Latest updates in Prediction Markets.

-

Nefu

Nefu - 31 Dec 2025

- Getting started

What is DeFi? A Simple Beginner's Guide to Decentralized Finance

What is DeFi? A Simple 2026 Beginner's Guide to Decentralized Finance Imagine a financial system where you can earn interest, get a loan, or trade assets directly with other people—without a bank, broker, or any central authority in the middle. That's the promise of Decentralized Finance, or DeFi. For beginners, it looks like a confusing maze of strange terms, high yields, and catastrophic headlines about hacks. DeFi is simply a set of financial applications built on blockchains, primarily Ethereum, that use smart contracts (automated code) to replace traditional intermediaries like banks. While you can earn attractive returns, approaching DeFi without understanding it is one of the fastest ways to lose your crypto. This makes DeFi a topic you should explore only after understanding the fundamentals of what cryptocurrency is and how wallets work. This guide strips away the jargon. You'll learn what DeFi actually does, how its key pieces work, the real risks involved, and the safest first steps you can take as a beginner.DeFi vs. Traditional Finance: The Core DifferenceActivity Traditional Finance (TradFi) Decentralized Finance (DeFi)Hold Money Bank account controlled by institutions Self-custody wallet you controlEarn Interest Low savings rates Direct lending protocolsGet a Loan Credit checks and delays Instant smart contract loansTrade Assets Broker intermediaries DEXs with permissionless accessIn TradFi, you trust institutions. In DeFi, you trust code and your own security practices. This is why understanding hot vs. cold wallets is essential before using DeFi.How DeFi Works: The 4 Key Building Blocks 1. Public Blockchains (Ethereum, Solana, Layer 2s) Most DeFi applications live on Ethereum, with lower-fee environments like Arbitrum, Optimism, and Solana gaining popularity. If you don’t already own ETH, start with How to Buy Ethereum for Beginners.2. Smart Contracts Smart contracts are programs that automatically execute financial logic. There is no customer support and no reversals. Before interacting with any protocol, beginners should review the biggest crypto mistakes beginners make.3. Web3 Wallets (MetaMask, Phantom) DeFi doesn’t use usernames or passwords. You connect with a wallet that signs transactions. Before touching DeFi, set up a wallet using the Best Crypto Wallets for Beginners guide and understand seed phrase security completely.4. Stablecoins (USDC, DAI) Stablecoins act as digital dollars and are the foundation of DeFi lending and trading. To acquire crypto easily, see How to Buy Crypto with a Credit Card or PayPal.What Can You Do in DeFi? 1. Lending & Borrowing Protocols like Aave and Compound allow users to lend stablecoins and earn yield. Beginner takeaway: Lending stablecoins is one of the safest DeFi entry points.2. Decentralized Exchanges (DEXs) DEXs like Uniswap allow wallet-to-wallet trading without intermediaries. Before using a DEX, read How to Transfer Crypto from an Exchange to a Wallet Safely.3. Yield Aggregators Platforms like Yearn automate advanced strategies. Beginner warning: These increase smart contract risk and are not suitable for first-time users.The Real Risks of DeFiSmart contract exploits Impermanent loss Rug pulls and admin key abuse Irreversible user mistakesStrong wallet hygiene is mandatory for DeFi usage.A Safe 5-Step Path for BeginnersSecure your wallet (preferably with hardware) Practice on testnets Start with small stablecoin deposits Verify URLs, audits, and approvals Progress slowlyFAQ Is DeFi legal? Generally yes, but taxes and regulations still apply. See:Is Crypto Legal Where I Live? Ultimate Guide to Crypto Regulatory & Tax ComplianceAre high APYs real? Usually not. High yields almost always mean high risk. Do I need technical skills? No, but caution and patience are required.Final Thoughts DeFi is a powerful financial system—not a shortcut to easy money. Master the basics of crypto ownership and wallets first, then explore DeFi with small amounts on reputable protocols. When you’re ready, continue into the DeFi & Yield pillar to learn sustainable strategies and deeper protocol analysis.