-

Nefu

Nefu - 29 Dec 2025

- Prediction markets

What Is Kalshi? The Complete Beginner’s Guide to the Regulated Prediction Market Giant

What Is Kalshi? The Complete Beginner’s Guide to the Regulated Prediction Market Giant While crypto degens battled regulators on offshore platforms, Kalshi took the boring but brilliant route: full CFTC regulation. Launched in 2021, this New York-based exchange became the first federally overseen prediction market, trading event contracts on everything from elections to sports parlays, weather, and IPOs. By late 2025, Kalshi hit $11 billion valuation after a $1 billion raise, processing billions in monthly volume, often outpacing Polymarket. Partnerships with CNN, CNBC, and even Phantom wallet for crypto access cemented its mainstream push. Over 90% of activity is now sports, but it started with macro events. If our What Is Polymarket? guide showed the wild crypto side, Kalshi is the polished, legal Wall Street version, fiat-friendly and state-proof thanks to federal oversight.How Kalshi Works (Simple Explanation) Kalshi offers binary event contracts: Yes/No on real-world outcomes, priced from $0.01 to $0.99 reflecting probability. Buy Yes if you think it happens, No otherwise. Correct? $1 payout. Wrong? Zero. Markets cover politics (post-court wins), sports (including parlays and transfer portals), finance, climate, culture. Resolution uses official sources, automated where possible. Self-certification lets quick listings, like college player transfers. Fiat deposits, no crypto needed originally, though now bridging in. Why Kalshi Exploded in 2025 Regulation was the moat. Court victories over CFTC on elections, state pushback dismissed, opened floodgates. Massive funding fueled marketing, broker integrations, media deals. Volume surged to $5-6 billion monthly peaks, app downloads soared. Sports dominance and parlays attracted gamblers seeking legal alternatives. It turned prediction markets into a trillion-dollar vision, financializing opinions safely. Kalshi vs Polymarket, Worm.wtf, and Augur: Key Advantages The regulated vs decentralized showdown.Against Polymarket: Both hit billions in volume, but Kalshi wins US legality, fiat ease, no VPN nonsense. Polymarket edges global crypto access, niche markets. Kalshi feels like a stock app; Polymarket like a degen playground. Against Worm.wtf: Solana's creator-focused chaos contrasts Kalshi's institutional polish. Worm cheaper and faster for crypto natives, but Kalshi offers regulatory safety, broader events including sports parlays. Against Augur: The decentralized pioneer lacks Kalshi's liquidity, UX, volume. Kalshi provides trust via CFTC, easier onboarding. Augur uncensorable; Kalshi compliant and massive scale. Overall, Kalshi dominates for US users wanting legal, high-volume trading without crypto hassle.Who Should Use Kalshi? Americans seeking regulated exposure, sports fans loving parlays, macro traders hedging real events. Beginners appreciate fiat and app simplicity. Less for global degens craving wild topics or low fees, Polymarket or Worm better there. How to Get Started on Kalshi (Step-by-Step)Download the Kalshi app or visit kalshi.com.Sign up with ID verification (KYC required).Deposit fiat via bank.Browse markets in sports, politics, etc.Buy Yes/No contracts.Trade or hold to settlement.Snappy mobile experience, bonuses via referrals.Is Kalshi Safe and Legit? CFTC-regulated DCM, full oversight, surveillance partnerships. Faces state gambling lawsuits but federal preemption holds. Typical risks: low liquidity niches, but strong for majors. Start small. Final Thoughts — Is Kalshi Worth Trying in 2025? Kalshi turned prediction markets mainstream, proving regulation can fuel explosion rather than kill it. With sports dominance and media ties, it is the gateway for millions into event trading. If legality and scale matter, this is your platform. The tortoise won the race. Check out the rest of our Prediction Markets category for deep dives on other platforms. Next up: more guides to help you navigate this growing space.

-

Nefu

Nefu - 29 Dec 2025

- Getting started

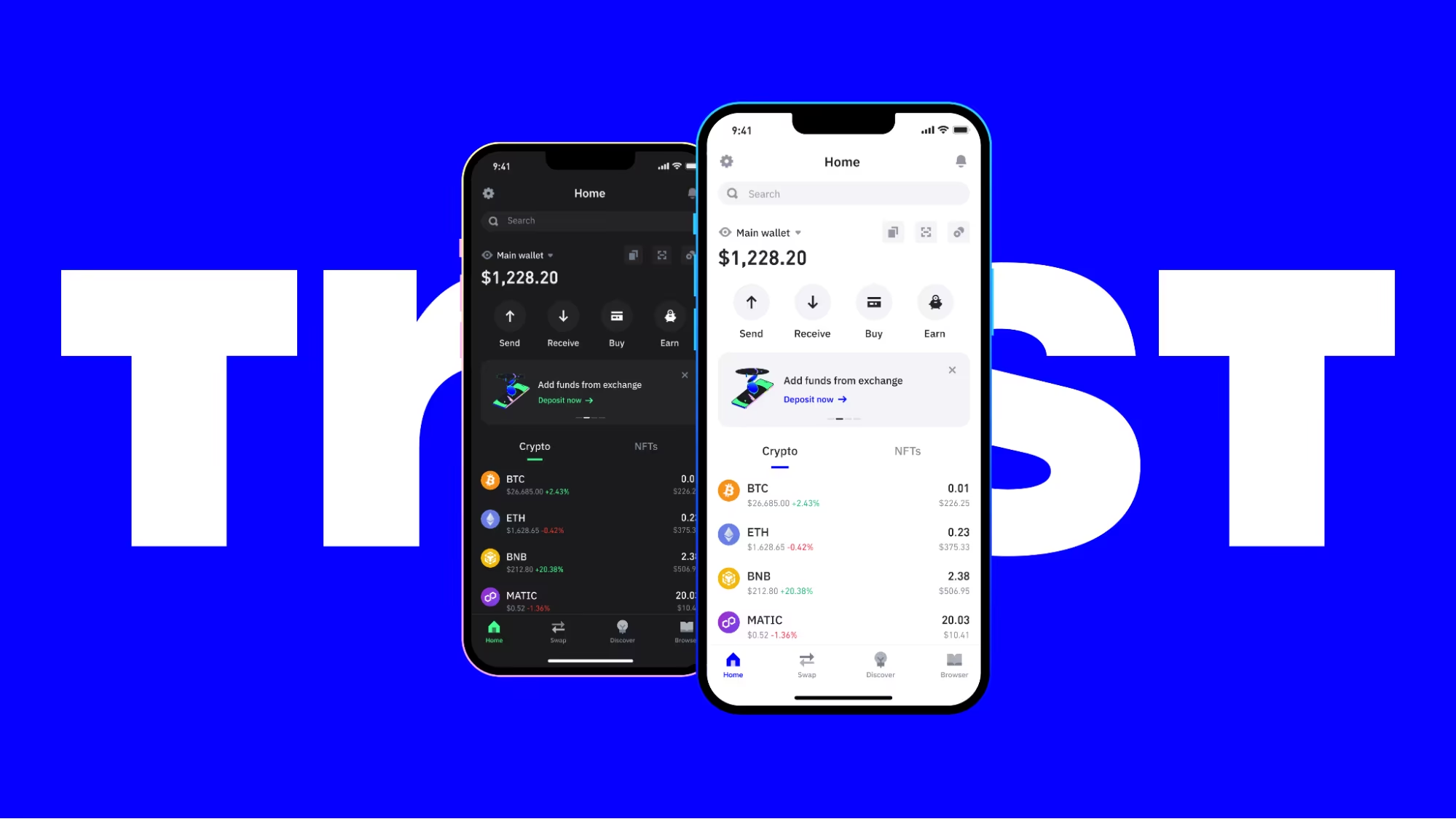

How to Set Up Trust Wallet: Step-by-Step Tutorial for Beginners

I first started using Trust Wallet in 2021, when I started trading bsc memecoins, and I even had friends who launched their own coins. I was having lots of fun in defi playing around on binance smart chain because the gas fee's were really cheap. I learned to trust Trust wallet. Trust Wallet is one of the most widely used mobile non-custodial wallets in 2026, trusted by millions of beginners and experienced users alike. It supports over 10 million assets across 100+ blockchains—including Bitcoin, Ethereum, Solana, BNB Chain, Polygon, Avalanche, and many more—making it a true all-in-one solution. Key features include built-in Web3 browser for dApps, direct token swaps, NFT management, staking for rewards, and easy crypto purchases. As a fully self-custodial wallet, you control your private keys and recovery phrase—no third party can access your funds. This aligns perfectly with the self-custody principles in What is Cryptocurrency? A Complete Beginner's Guide to Blockchain in 2026. In this guide, we'll walk you through setting up Trust Wallet from scratch, securing your recovery phrase, and getting ready for your first transactions—while avoiding the 10 Biggest Crypto Mistakes Beginners Make in 2026. Why Choose Trust Wallet as a Beginner? Trust Wallet stands out for new users because:Massive Chain Support: One app for almost every major blockchain and token. Beginner-Friendly Interface: Clean design with simple navigation. Built-in Tools: Buy crypto with fiat, swap tokens, stake for yields, browse dApps, and collect NFTs—all without leaving the app. Strong Security: Local encryption, biometric locks, and no KYC required. Free and Open-Source: No hidden fees for basic use, with transparent code.For a full comparison, see Best Crypto Wallets for Beginners in 2026: Top Picks and Reviews. If you're focused on Ethereum, compare with How to Set Up MetaMask Wallet: Step-by-Step Tutorial for Beginners 2026, or for Bitcoin Ordinals with How to Set Up Xverse Wallet: Step-by-Step Tutorial for Beginners 2026. Prerequisites Before StartingA smartphone (iOS or Android)—Trust Wallet is mobile-first (no official browser extension). A private, quiet place to write down your recovery phrase. Paper and pen—never store the phrase digitally at first.Step-by-Step Guide to Setting Up Trust Wallet The setup takes just a few minutes. Step 1: Download Trust Wallet from Official Sources Always use official channels to avoid fake apps:iOS: App Store – Search "Trust: Crypto & Bitcoin Wallet" or visit https://apps.apple.com/app/trust-crypto-bitcoin-wallet/id1288339409 Android: Google Play Store – Search "Trust Wallet" or visit https://play.google.com/store/apps/details?id=com.wallet.crypto.trustappWarning: Only download from these links or the official site https://trustwallet.com. Fake apps on third-party stores can steal your funds. Step 2: Install and Open the AppInstall the app and open it. You'll see the welcome screen with two main options: Create a new wallet or I already have a wallet (for importing).Step 3: Create a New WalletTap Create a new wallet. Read and accept the terms (emphasizing self-custody responsibility). The app generates a 12-word secret recovery phrase. Write down the words exactly in order on paper. Do not screenshot, type into notes, or share with anyone. Confirm by selecting the words in the correct sequence.This phrase is your master key—if you lose your phone, it's the only way to recover your assets. Store it offline in a secure location. For safe handling tips, see How to Transfer Crypto from Exchange to Wallet Safely in 2026. Step 4: Secure Your WalletEnable passcode (6-digit PIN) — required for extra protection. Turn on biometrics: Face ID (iOS) or fingerprint (Android) for quick, secure access. Trust Wallet encrypts everything locally—no data is sent to servers.Step 5: Explore the DashboardYour home screen shows total portfolio value and top assets. Use the search bar to add tokens or switch networks. Tap Receive to view addresses for any supported chain (e.g., BTC, ETH, SOL).Trust Wallet automatically detects and supports most popular tokens. Step 6: Fund Your Wallet (Optional Test) To verify everything works:Use the Buy feature: Purchase crypto directly with credit card, Apple Pay, Google Pay, or bank transfer (via trusted partners). Or transfer from an exchange using your Trust Wallet receive address.New to buying? Follow How to Buy Bitcoin for Beginners: Complete Step-by-Step Guide 2026, How to Buy Ethereum for Beginners: Complete Step-by-Step Guide 2026, or How to Buy Crypto with Credit Card or PayPal in 2026. Practice with small amounts first. Importing an Existing Wallet into Trust Wallet Already have a wallet elsewhere (e.g., MetaMask, Phantom, OKX, or Xverse)?Choose I already have a wallet on the welcome screen. Select Multi-Coin Wallet or the specific chain. Enter your 12/24-word recovery phrase. Trust Wallet imports balances, tokens, and transaction history across supported chains.Advanced Features to Explore Later Once set up:Web3 Browser: Connect to dApps like Uniswap, PancakeSwap, or Solana DeFi. Swap: Exchange tokens cross-chain with best rates. Stake: Earn rewards on assets like BNB, ETH (via Lido), or SOL. NFT Tab: View and manage collections. Security Scanner: Warnings for risky transactions.These tie into strategies like Dollar Cost Averaging Explained: The Best Strategy for Crypto Beginners in 2026. Common Issues and TroubleshootingTokens Not Showing: Manually add custom tokens via search or contract address. Network Congestion: Switch RPCs if transactions are slow. App Updates: Always keep the latest version for security patches. Official support: https://community.trustwallet.comEssential Security TipsNever share your recovery phrase or passcode. Beware of phishing—Trust Wallet will never ask for your phrase. Verify dApp connections carefully. Avoid impulsive trades driven by hype—review Crypto Investing Psychology: Mastering Emotions and Avoiding FOMO as a Beginner in 2026.Trust Wallet makes managing a diverse portfolio simple and secure. Pair it with knowledge of top assets from Top 10 Cryptocurrencies Explained for Absolute Beginners in 2026 or Bitcoin vs Ethereum: Which is Better for Beginners in 2026. I been using trust for years, its a good starter wallet..

-

Nefu

Nefu - 28 Dec 2025

- Airdrop farming

What Actions Actually Earn Airdrop Points (And What Doesn’t)

Introduction One of the biggest misconceptions in airdrop farming is that every action counts equally toward points.Many users waste gas, time, and capital on meaningless transactions while missing the actions that actually matter. In this guide, we’ll break down which actions earn points, which do not, and why behavior matters more than volume. This article builds on concepts from How Crypto Airdrop Points Systems Really Work and Avoiding Red Flags: Wallet Hygiene and Compliance in Airdrop Farming.Understanding “Point-Worthy” Actions Projects track multiple types of activity to determine eligibility and allocation. Actions generally fall into two categories:On-Chain Actions – Direct interactions with blockchain protocols Off-Chain Actions – Community engagement, governance, or testingEach carries different weighting and verification methods, and many actions are only meaningful when combined with proper wallet hygiene.On-Chain Actions That Earn Points These are actions recorded directly on-chain. They are objective and verifiable. 1. Token TransfersOnly meaningful when interacting with protocol contracts Repeated wallet-to-wallet transfers often ignored Strategic transfers (e.g., staking or sending to liquidity pools) are valued2. StakingLong-term staking shows commitment Short bursts may earn points in some systems but are lower weighted Longer staking → higher point multiplier3. Liquidity ProvisionProviding liquidity to pools is highly weighted in most DeFi airdrops Quality is evaluated: size, duration, and risk taken4. Governance ParticipationVoting, proposals, and forum discussions may all count Repeated spam votes do not Projects monitor uniqueness of voter behavior5. Contract InteractionMeaningful contract calls (minting, swapping, bridging) Low-value or repeated calls are often filteredOff-Chain Actions That Earn Points Some points come from activity outside the blockchain, often via project dashboards or community platforms. 1. Community EngagementDiscord participation, Telegram messages Weighted for unique, constructive activity, not spam Verified accounts often get higher weight2. Testnet FeedbackBug reports, feature tests, and testnet staking Shows real contribution3. Social Media ParticipationSharing content, commenting, or participating in challenges Usually tracked via project dashboards or manual verification4. Developer ContributionsGitHub commits, pull requests, open-source contributions Rare but highly weighted in technical projectsActions That Often Do NOT Earn Points Repetitive, Low-Value TransactionsMoving tokens between your own wallets repeatedly “Dusting” or micro-transfers to appear activeBulk or Automated FarmingScripts that claim rewards automatically These often trigger anti-Sybil filtersExcess Gas SpendingSpending more gas doesn’t equal more points Smart usage is rewarded, spam is ignoredDuplicate Accounts or Wallet ClonesProjects monitor patterns across multiple wallets High risk for disqualification or blacklistingTip: Avoid actions that appear mechanical or automated — points systems are designed to reward human-like behavior.Timing and Frequency Matter Points are not just about what you do but also when you do it.Burst Farming: Performing all actions in a short window is suspicious Steady Engagement: Points accumulate more reliably over time Snapshots: Some projects evaluate points at specific times; actions outside the snapshot may not countProper timing strategies link back to Time-Based vs Volume-Based Airdrop Points Systems.Multi-Wallet Considerations If you operate multiple wallets, remember:Spread meaningful actions across wallets gradually Avoid identical sequences across wallets Maintain wallet hygiene as described in Avoiding Red Flags: Wallet Hygiene and Compliance in Airdrop FarmingQuality always outweighs quantity in points accumulation.Real-World ExamplesAction Points Likely Earned NotesStaking 100 tokens for 30 days High Shows commitment and riskSending tokens between your own wallets Low/0 Often ignored by scoring enginesParticipating in governance vote Medium Repeated spam votes ignoredPosting meaningful bug report High Off-chain but verified and weightedAutomated faucet claims Low/0 Can trigger anti-Sybil detectionTools to Track “Point-Worthy” ActionsOn-Chain Explorers: Track meaningful transactions, staking, and LP participation Project Dashboards: Monitor off-chain actions, tests, and community contributions Custom Spreadsheets: Combine on-chain + off-chain metrics for easier managementThese tools help maintain clarity and avoid wasted effort.Conclusion Farming points effectively is about signal quality, timing, and wallet hygiene, not simply volume. Focus on: meaningful on-chain interactions verified off-chain contributions consistency and timing clean multi-wallet managementFollowing these strategies ensures you maximize point accumulation without risking disqualification.Next step in the Points Systems cluster: Time-Based vs Volume-Based Airdrop Points Systems

-

Nefu

Nefu - 27 Dec 2025

- Airdrop farming

Avoiding Red Flags: Wallet Hygiene and Compliance in Airdrop Farming

Avoiding Red Flags: Wallet Hygiene and Compliance in Airdrop Farming Airdrop farming is lucrative but comes with risks. Projects actively monitor wallets for suspicious activity and may disqualify participants who appear to be abusing systems. Being flagged as a Sybil—when a project detects multiple wallets controlled by a single person—is a common and serious risk. Proper wallet hygiene and compliance practices can protect your rewards and maintain long-term eligibility. In this article, we’ll cover essential practices to maintain wallet hygiene, reduce Sybil risk, and stay compliant while farming airdrops. Related reading: Wallet Management Best Practices for Airdrop FarmersRelated reading: Cold vs Hot Wallets: Optimizing Security and Eligibility Understanding Red Flags Red flags are behaviors or patterns that make projects suspicious of your wallets. Common triggers include:Multiple wallets performing identical transactions Rapid, bulk interactions across several wallets Using the same IP or device fingerprint for multiple wallets Storing and moving rewards in ways that look like automationProjects may blacklist wallets or cancel rewards if they suspect a Sybil attack or other abuse.Sybil Risk Explained Sybil attacks involve creating multiple wallets to unfairly increase rewards. While using multiple wallets is legitimate for diversification, projects want to detect abuse. Key signals of a Sybil risk:Identical Transaction Patterns Sending the same amount of tokens or staking across multiple wallets at the same time.High Wallet Count on a Single Chain Holding dozens of wallets that all perform similar interactions.IP / Device Overlap Accessing multiple wallets from the same IP or device without mixing network sources.Mitigating these risks is part of proper wallet hygiene and compliance.Wallet Hygiene Best PracticesSeparate Private Keys and Seed Phrases Every wallet must have a unique key and seed. Never reuse hot wallet credentials across projects.Segment Wallets by Purpose Hot wallets for active participation Cold wallets for secure storage Experimental wallets for testing new protocolsConsistent Naming Conventions {Chain}-{WalletType}-{Number} Example: ETH-Hot-01, SOL-Cold-02Fund Hot Wallets Minimally Only keep the necessary balance for active interactions. Immediately transfer earned rewards to cold wallets to reduce risk exposure.Rotate IPs and Devices When Needed Use VPNs or different networks carefully to reduce overlap without triggering anti-abuse mechanisms.Stagger Interactions Across Wallets Avoid performing the same action simultaneously across multiple wallets. Randomize timing to mimic natural user behavior.Tip: Proper hygiene not only reduces Sybil risk but also prevents losses due to hacking or mismanagement.Compliance Practices for Airdrop FarmingDocument Wallet Activity Keep a spreadsheet or ledger with wallet addresses, actions, and rewards claimed. Supports dispute resolution if a project questions eligibility.Follow Project Rules Closely Each airdrop has specific requirements: minimum holdings, staking periods, or interaction tasks. Ignoring rules can automatically disqualify wallets.Avoid “Shortcuts” Scripts, bots, or auto-claim tools may speed up farming but often violate terms of service. Stick to manual or project-sanctioned tools.Educate Yourself on Chain-Specific Compliance Different blockchains may have different norms for staking, governance, and snapshots. Following chain rules ensures long-term eligibility across multi-chain airdrops.Example: Safe Multi-Wallet Strategy Scenario: A user wants to farm Ethereum and Solana airdrops without triggering red flags.Wallet Allocation: ETH-Hot-01 & ETH-Hot-02 for Ethereum interactions SOL-Hot-01 & SOL-Cold-01 for Solana participation and storageActions Taken: Interactions are staggered by 10–15 minutes between wallets Different IPs used for each wallet, where possible Ledger maintained to track project eligibility and rewardsOutcome: All wallets remain compliant and eligible Minimal risk of being labeled a Sybil Efficient reward collection with clear record-keepingAvoiding Common MistakesBulk Actions Across Wallets – Avoid identical transactions across multiple wallets in a short window. Ignoring Documentation – Not tracking wallet interactions increases the risk of errors and non-compliance. Neglecting Security Hygiene – Compromised wallets can expose multiple assets. Over-Farming with Excess Wallets – Too many wallets increase Sybil suspicion; balance quantity and activity naturally.Related reading: Wallet Management Best Practices for Airdrop FarmersTools to Aid Compliance and HygieneLedger or Trezor – For cold storage and secure reward holding Portfolio Trackers – Zerion, Debank, or custom spreadsheets VPNs / Network Tools – Rotate IPs safely for multiple wallet management Notification Tools – Alerts for staking periods, snapshots, or claimed rewardsThese tools help maintain hygiene, reduce risk, and support multi-chain farming strategies.Affiliate Mention (Optional) If you’re looking for recommended wallets, hardware, and tools for airdrop farming, check out our Wallet Hub Guide for a curated selection of options to maximize your efficiency and security.Conclusion Maintaining proper wallet hygiene and compliance is essential for long-term airdrop farming success. By following best practices—segmentation, staggered activity, separate keys, documentation, and Sybil risk mitigation—you can stay eligible for rewards, reduce exposure, and grow your airdrop portfolio confidently. Next step in this subcategory: Explore multi-chain farming strategies to expand your reach and maximize opportunities.

-

Nefu

Nefu - 27 Dec 2025

- Airdrop farming

Cold vs Hot Wallets: Optimizing Security and Eligibility

Cold vs Hot Wallets: Optimizing Security and Eligibility When farming crypto airdrops, your choice of wallet can make or break your strategy. Using the wrong type of wallet—or mismanaging your wallets—can lead to lost rewards, compromised security, or missed eligibility opportunities. In this article, we’ll break down cold vs hot wallets, explain their roles in airdrop farming, and provide practical guidance for a dual-tier wallet setup that maximizes participation while keeping your assets safe.Understanding Wallet Types Wallets fall into two broad categories: hot wallets and cold wallets. Each has unique benefits and trade-offs. Hot Wallets Hot wallets are connected to the internet and are commonly used for daily transactions, interacting with dApps, and participating in airdrops. Examples include MetaMask, Phantom, Trust Wallet, and Coinbase Wallet. Pros:Easy and quick access to multiple blockchain networks Direct integration with decentralized applications (DeFi, NFT platforms) Perfect for frequent airdrop participationCons:Greater exposure to online threats, phishing, and malware Requires careful security hygiene and monitoring Not ideal for storing large amounts of high-value assetsCold Wallets Cold wallets are offline storage solutions like Ledger and Trezor hardware wallets. They are highly secure and primarily used for storing high-value assets or long-term airdrop rewards. Pros:Nearly impervious to online attacks Ideal for long-term holding and high-value rewards Great for maintaining project credibility by demonstrating stable holdingsCons:Less convenient for frequent interactions with protocols Requires more effort to move funds when needed Multi-chain access can be more complexWhy You Need Both Relying exclusively on one wallet type can hurt your airdrop strategy:Hot Wallet Only: Maximizes ease of participation but exposes all assets to online risk. High-value airdrops are particularly vulnerable. Cold Wallet Only: Maximizes security but limits your ability to interact with protocols, participate in DeFi, or claim frequent small airdrops.A dual-tier wallet strategy leverages both wallet types, giving you the best of security and convenience. Related reading: Mastering Wallet Diversification for Airdrop FarmingSetting Up a Dual-Tier Wallet Strategy Here’s a step-by-step guide to implementing a balanced cold-hot wallet system. Step 1: Allocate Hot WalletsUse 1–3 hot wallets for active participation. Keep balances minimal to reduce risk exposure. Connect hot wallets only to reputable protocols and airdrop sources.Tips:Create a dedicated browser or wallet extension profile for airdrop interactions. Enable password protection and two-factor authentication (2FA) where possible.Step 2: Allocate Cold WalletsUse 1–2 hardware wallets to store earned rewards. Move significant airdrop tokens from hot wallets to cold wallets regularly. Consider a multi-chain hardware wallet if you participate in cross-chain airdrops.Tips:Keep seed phrases offline and in multiple secure locations. Regularly update firmware to maintain security.Step 3: Track Wallet Roles Maintain a clear ledger or spreadsheet:Wallet Type Role Chains NotesETH-Hot-01 Hot Active Participation Ethereum Small ETH and ERC-20 tokensSOL-Hot-01 Hot Active Participation Solana Participate in Solana airdropsLedger-Cold-01 Cold Storage Ethereum + Solana Move rewards from hot wallets weeklyThis ensures you know which wallet does what and prevents accidental overlap or mismanagement.Optimizing Airdrop Eligibility Wallet type affects eligibility in many ways:Project SnapshotsSome projects take periodic snapshots of wallet balances. Cold wallets can ensure your holdings are stable, improving eligibility for tiered airdrops.Interaction RequirementsHot wallets allow you to interact with contracts, vote in governance, or mint NFTs, all of which can increase airdrop chances.Multiple Wallets per ChainSplitting holdings between wallets can help you qualify for multiple tiers of rewards. Hot wallets handle active interactions, cold wallets show stable holdings for snapshots.Security Best PracticesSeparate Private KeysDo not reuse keys between hot and cold wallets. Each wallet should have its own secure backup.Minimal Hot Wallet ExposureOnly fund hot wallets with the necessary amount for ongoing airdrop participation. Immediately transfer earned rewards to cold storage if possible.Regular AuditsReview wallet activity monthly. Remove dormant hot wallets or consolidate small balances for efficiency.Phishing and Scam AwarenessNever share private keys or seed phrases. Verify URLs and dApp legitimacy before connecting your wallet.Case Study: Successful Dual-Tier Strategy Scenario: A user participates in both Solana and Ethereum airdrops.Hot Wallets: SOL-Hot-01 for Solana interactions ETH-Hot-01 for Ethereum NFTs and DeFi participationCold Wallets: Ledger-Cold-01 storing all accumulated airdrop tokens Ledger-Cold-02 reserved for high-value governance token snapshotsOutcome: The user qualifies for multiple tiers of rewards Minimal risk of losing significant tokens to online threats Clear audit trail for tracking earned rewardsThis layered approach balances eligibility with security and prepares the user for multi-chain farming growth.Common Mistakes to AvoidMixing Funds: Using hot wallets for long-term storage defeats the purpose of diversification. Ignoring Snapshots: Cold wallets with stable holdings are crucial for tiered or retroactive airdrops. Neglecting Security Hygiene: Failing to secure hot wallets or regularly update cold wallets invites loss.Related reading: Wallet Management Best Practices for Airdrop FarmersFuture reading: Avoiding Red Flags: Wallet Hygiene and Compliance in Airdrop FarmingConclusion A dual-tier wallet strategy is a foundational component of a successful airdrop farming operation. By combining hot wallets for active participation with cold wallets for secure storage, you can maximize eligibility, minimize risk, and keep your operations organized across multiple chains and projects. Security, organization, and clear tracking are your allies in this competitive space.Next StepsSet up one hot wallet per chain you actively participate in Acquire a hardware cold wallet for storing earned rewards Implement a ledger or spreadsheet to track wallet roles and airdrop activityComing next in this subcategory: Wallet Management Best Practices for Airdrop Farmers

-

Nefu

Nefu - 27 Dec 2025

- Airdrop farming

How Projects Detect Sybil Wallets in Points-Based Airdrops

Introduction Modern airdrops rely heavily on Sybil detection to ensure points and rewards are allocated to real, valuable users. Projects face constant threats from automated farming, multi-wallet abuse, and repeated exploit attempts. Understanding how Sybil detection works is essential for safe airdrop farming. This article builds on previous cluster articles: How Crypto Airdrop Points Systems Really Work, What Actions Actually Earn Airdrop Points, and Time-Based vs Volume-Based Airdrop Points Systems.What is a Sybil Wallet? A Sybil wallet is one of multiple wallets controlled by the same entity to exploit rewards. Common characteristics: Identical or near-identical transaction patterns Shared network or IP addresses Repetitive or automated behavior Overlapping community engagementProjects flag or disqualify these wallets to protect fair distribution.How Projects Detect Sybil Wallets 1. On-Chain HeuristicsTransaction timing patterns Interaction overlap with known farming wallets Repeated contract calls across multiple wallets2. Off-Chain SignalsDiscord and social media account analysis Email or identity cross-referencing Behavioral fingerprints in community contributions3. Network and IP AnalysisDetect multiple wallets from same IP ranges Proxy or VPN usage patterns Cluster detection to identify linked wallets4. Graph & Cluster AnalysisVisualization of wallet interconnections Identifying unusual transaction networks Measuring “uniqueness” vs known Sybil patternsStrategies to Minimize Sybil RiskWallet Hygiene Keep wallets separate, clean, and independent Avoid shared private keys or accounts across campaignsDiverse Behavior Vary transaction timing Engage in a mix of on-chain and off-chain activityAvoid Automation & Scripts Automated bots are the fastest way to get flagged Human-like behavior is rewardedTrack Points and Flags Maintain a log of wallet actions Monitor for unusual patterns or deductions (How to Track Airdrop Points Across Multiple Wallets)Real-World ExamplesDetection Method Example Effect on WalletsTransaction overlap Two wallets consistently stake at same block times Points capped or disqualifiedSocial media fingerprints Same Discord account linked to multiple wallets Off-chain points removedIP clustering Multiple wallets using same VPN node Triggered review or banHistorical behavior Sudden burst of repeated contract interactions Snapshot points reducedUnderstanding these patterns helps farmers avoid accidental Sybil labeling.Balancing Activity and SafetyFocus on quality over quantity: fewer wallets with meaningful activity outperform many low-quality wallets Stagger actions to mimic organic usage Avoid repeating the same off-chain engagement across wallets Combine insights with Time-Based vs Volume-Based Points Systems to optimize timingKey TakeawaysSybil detection is multi-layered, combining on-chain, off-chain, and network analysis Over-automation and repetitive patterns are the most common triggers Clean multi-wallet strategy and human-like activity reduce risk Knowledge of scoring type (time vs volume) improves eligibility and allocationNext in the cluster: Optimizing Airdrop Points Without Overfarming or Getting Flagged

-

Nefu

Nefu - 27 Dec 2025

- Airdrop farming

How to Track Airdrop Points Across Multiple Wallets

Introduction Tracking airdrop points across multiple wallets is essential for any serious farmer. Without organized monitoring, it’s easy to overfarm, miss high-value actions, or inadvertently trigger Sybil detection. This article completes the Points Systems cluster, building on: How Crypto Airdrop Points Systems Really Work What Actions Actually Earn Airdrop Points Time-Based vs Volume-Based Points Systems How Projects Detect Sybil Wallets Optimizing Airdrop Points Without Overfarming or Getting FlaggedWhy Multi-Wallet Tracking MattersAvoid Redundancy: Prevent performing duplicate actions across wallets Maximize Points: Focus on wallets yielding the highest ROI Prevent Sybil Detection: Maintain unique behavior and timing per wallet Data-Driven Decisions: Identify patterns and adjust strategy based on resultsChoosing a Tracking Method 1. Spreadsheets (Manual)List each wallet with on-chain and off-chain actions Track points, timing, and cumulative totals Pros: Flexible, easy to customize Cons: Manual input can be error-prone for large numbers of wallets2. Dashboards & Project ToolsMany projects provide dashboards to see points per wallet Pros: Directly integrates with project data, reliable Cons: Limited to each project; not centralized3. Custom Scripts or TrackersPull on-chain data via APIs (etherscan, blockchain explorers) Aggregate across wallets for consistent analysis Pros: Automates tracking, scalable Cons: Requires technical knowledge and maintenanceWhat to TrackMetric Why It Matters NotesOn-chain actions Determines base points Transactions, staking, LP contributionsOff-chain actions Adds extra weight Discord, GitHub, testnets, social activityWallet timing Avoid burst patterns Helps prevent Sybil flagsCumulative points Evaluate ROI per wallet Identify underperforming walletsSnapshot alignment Ensure actions count Check when projects take snapshotsBest PracticesLabel & Organize Wallets Assign wallets to campaigns, projects, or scoring types Maintain clear naming conventionsStagger Actions Across Wallets Avoid performing identical sequences Introduce timing variation for human-like activityTrack Regularly Update daily or weekly depending on activity Highlight wallets at risk of low points or Sybil suspicionAnalyze & Adjust Reallocate effort to high-performing wallets Stop low-yield or risky activityBackup & Secure Data Keep spreadsheets or dashboards in secure storage Avoid exposing private keys or sensitive wallet infoTools to Enhance TrackingOn-Chain Explorers: Verify all blockchain interactions Multi-Project Dashboards: Consolidate data from multiple airdrops API Integrations: Automate data collection for large wallets Visualization Tools: Graph points over time and detect anomaliesKey TakeawaysOrganized tracking is the backbone of efficient and safe airdrop farming Maintain wallet hygiene, human-like behavior, and clear labeling Combine with cluster insights for points optimization, timing, and Sybil avoidance Data-driven decisions ensure maximum rewards while minimizing riskThis concludes the Points Systems cluster. For continued learning, explore other subcategories like Wallet Strategy.