-

Nefu

Nefu - 25 Dec 2025

- Portfolio management

Time-Based vs Threshold Rebalancing for Crypto Portfolios

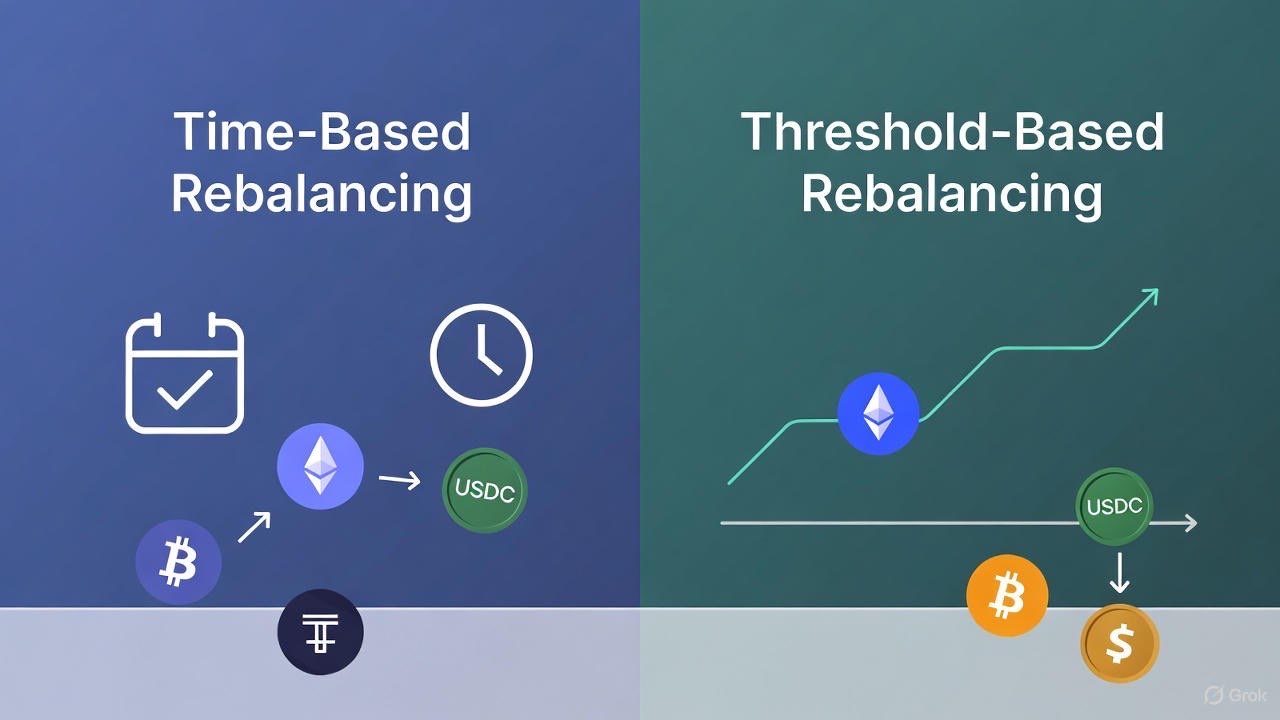

Understanding Time-Based vs Threshold Rebalancing Through a Story Meet Carlos, a software engineer who recently dove into crypto investing. He started with a simple allocation: 50% Bitcoin, 30% Ethereum, 20% a basket of promising altcoins. At first, he didn’t worry much about rebalancing — “the market will sort itself out,” he thought. Fast forward a few months: Bitcoin had a strong rally, Ethereum lagged a little, and some altcoins crashed hard. Carlos’s portfolio drifted heavily from his intended allocation. He realized that without rebalancing, his “balanced” portfolio was now more like a high-risk altcoin play. That’s when he decided to learn about time-based and threshold-based rebalancing. Rebalancing isn’t just a technical step — it’s about keeping your portfolio aligned with your goals, managing risk, and avoiding emotional decision-making. Related reading: How to Rebalance a Crypto PortfolioWhat Is Time-Based and Threshold Rebalancing? Time-Based RebalancingThis method involves adjusting your portfolio at fixed intervals: weekly, monthly, or quarterly. You stick to a schedule regardless of how much each asset has moved. Threshold-Based RebalancingHere, you only adjust when an asset’s weight moves beyond a set deviation from your target allocation. For example, if Bitcoin exceeds 45% of your portfolio when the target is 40%, you rebalance. Carlos tried both approaches to see which fit his style. Time-based rebalancing gave him structure and discipline, but sometimes he traded unnecessarily. Threshold-based rebalancing helped him avoid extra trades, but he occasionally missed subtle drifts that added up over time. Learn about other portfolio allocation strategies including Market Cap Weighted Allocation and Dynamic Allocation.Pros and Cons of Each Method Time-Based Rebalancing Advantages: Predictable and easy to automate Keeps discipline consistent Helpful for beginners who don’t want to monitor constantlyDisadvantages: May rebalance when it’s not necessary Can incur more trading fees if markets are calm Sometimes overreacts to small, insignificant fluctuationsThreshold-Based Rebalancing Advantages: Trades only when needed Reduces unnecessary fees Reacts to actual portfolio driftDisadvantages: Requires tracking asset weights continuously May miss small but consistent drifts Could feel less disciplined if thresholds are too wideCarlos found that a hybrid approach often works best: check monthly (time-based) but only trade if assets drift more than a set threshold (threshold-based). This gave him both discipline and efficiency. For practical steps, see Step-by-Step Guide to Rebalancing.How to Decide Which Method Fits You When choosing a rebalancing method, consider:Portfolio Size: Small portfolios may not benefit from frequent rebalancing due to fees. Trading Costs: High-fee exchanges favor threshold-based adjustments. Volatility: Highly volatile altcoins may require tighter thresholds to avoid excessive drift. Personal Discipline: If you struggle to remember to rebalance, time-based schedules can help.Imagine Maria, a casual investor, who sets a monthly rebalancing day on her calendar. Even during busy work weeks, she executes trades systematically. Meanwhile, her friend Leo, an active trader, prefers threshold-based rebalancing to react only when deviations exceed 5%, saving on fees during calm markets. Related reading: Tracking Crypto Portfolio PerformanceStep-by-Step Example: Hybrid RebalancingSet Target Allocation BTC 50% ETH 30% Altcoins 20%Define Thresholds BTC ±5% ETH ±5% Altcoins ±5%Schedule Monthly Review Review all positions once per month (time-based).Check Threshold Breaches Only execute trades if the drift exceeds ±5%.Rebalance Sell overweight assets and buy underweight assets to return to target allocation.This approach helps limit emotional trading, reduce unnecessary fees, and maintain risk alignment. Step-by-step illustration: How to Rebalance a Crypto PortfolioLessons Learned From Real InvestorsCarlos: Hybrid approach balanced discipline and flexibility. Maria: Time-based rebalancing fits her busy schedule. Leo: Threshold-based rebalancing prevents trading too often in stable markets.All three achieved the same goal: keeping their portfolios aligned with long-term strategy, while managing risk in different ways. See also Dynamic Portfolio Allocation for managing volatility dynamically.Common Pitfalls to AvoidIgnoring trading fees, which can eat into returns Rebalancing emotionally during sudden market swings Setting thresholds too tight, resulting in over-trading Forgetting to track portfolio drift altogetherCarlos once panicked during a sudden altcoin pump and rebalanced without a plan, realizing afterward that he had sold part of his winners prematurely. From then on, he stuck to rules and thresholds, avoiding emotional mistakes. For mistakes and best practices, see Common Rebalancing MistakesBenefits of Proper RebalancingReduces exposure to unintended risk Locks in gains systematically Improves long-term risk-adjusted returns Provides peace of mind by enforcing a disciplined approachRebalancing is like maintaining a car: regular checks prevent breakdowns and keep performance smooth. Learn more about Portfolio Management BasicsFinal Thoughts Time-based and threshold-based rebalancing are tools, not magic bullets. The best strategy depends on your:Risk tolerance Trading fees Portfolio size Personal disciplineBy understanding these methods and considering real-world scenarios like Carlos, Maria, and Leo, investors can maintain control, reduce risk, and improve long-term performance without reacting emotionally to every market move. The key takeaway: rebalancing turns volatility into a controlled tool, helping you stay aligned with your goals and maintain a resilient crypto portfolio.

-

Nefu

Nefu - 25 Dec 2025

- Portfolio management

Volatility-Adjusted Portfolio Allocation in Crypto

Volatility-Adjusted Allocation — Explained Like a Real Investor Experiences It Let’s start with a familiar story. Jason built his first serious crypto portfolio during a bull market. Everything was green. His allocation looked diversified:Bitcoin Ethereum A handful of fast-moving altcoinsAt first, the gains were exciting. But when the market turned, Jason noticed something strange:his portfolio didn’t just go down — it whipped violently up and down, far more than he expected. Bitcoin dipped 10%.Ethereum dipped 15%.Some altcoins dropped 40% in days. Jason wasn’t “overexposed” by percentage — he was overexposed by risk. Related reading: Market Cap Weighted Allocation ExplainedWhat Is Volatility-Adjusted Allocation (In Plain English)? Volatility-adjusted allocation sizes positions based on how violently they move, not just how important they seem. Instead of asking:“How much of my portfolio should this asset be?”You ask:“How much risk does this asset contribute?” The core idea:High-volatility assets → smaller position sizes Low-volatility assets → larger position sizesThe goal isn’t to kill upside.The goal is to keep total portfolio risk consistent, even when markets get chaotic. Learn more about Dynamic Portfolio Allocation.Why Normal Allocations Break in Crypto Traditional allocation methods assume assets behave somewhat calmly. Crypto does not. Consider this:Bitcoin might swing ±5–10% in a week Ethereum might swing ±10–20% Smaller alts can swing ±30–60%If you allocate 20% to each, your portfolio risk is not evenly distributed — it’s dominated by the wildest asset. Related: Time-Based vs Threshold RebalancingHow Volatility-Adjusted Allocation Thinks About Risk Instead of equal capital weights, it targets equal risk contribution. Example mindset:Bitcoin = slow-moving anchor Ethereum = medium volatility Altcoins = high volatilityRather than this:BTC 40% ETH 30% Alts 30%You might see something like:BTC 50% ETH 30% Alts 20%Even though alts are only 20%, they may still contribute as much risk as Bitcoin. For more on measuring risk: How to Track Crypto Portfolio PerformanceA Story: Two Portfolios, Same Assets — Different Outcomes Jason tried two portfolios during the same volatile period. Portfolio A: Equal Capital AllocationBTC 40% ETH 30% ALT 30%Result:Large drawdowns Emotional stress Forced selling during panicPortfolio B: Volatility-Adjusted AllocationBTC 55% ETH 30% ALT 15%Result:Smaller drawdowns Fewer panic decisions Easier to hold through volatilitySame assets.Same market.Very different experience. See also Rebalancing Step-by-Step Guide for executing adjustments.How Volatility Is Usually Measured (Without Overcomplicating It) Most investors use:Historical price swings Average percentage movement Relative volatility compared to BitcoinA simple rule of thumb:If an asset moves twice as much as Bitcoin, give it roughly half the weightRelated metric insights: Performance Metrics That Actually MatterStep-by-Step: How Volatility-Adjusted Allocation Works in Practice Step 1: Identify Your Assets List everything in your portfolio. Step 2: Assess Relative Volatility Group assets mentally:Low volatility (BTC) Medium volatility (ETH, large caps) High volatility (alts, narratives, memes)Step 3: Decide Total Risk Level Ask yourself:“How much drawdown can I realistically tolerate?” Step 4: Assign Smaller Weights to Wild Assets High-volatility assets get capped — not eliminated. Step 5: Rebalance When Volatility Shifts As markets calm or heat up, weights adjust. For full execution guide: How to Rebalance a Crypto PortfolioWhy This Feels Better Emotionally (And That Matters) Jason noticed something unexpected after switching. He slept better. When Bitcoin dipped, it didn’t feel catastrophic.When altcoins dumped, they no longer hijacked his emotions. Volatility-adjusted allocation:Reduces emotional overreaction Makes drawdowns survivable Keeps decision-making rationalRelated reading: Risk Management in Crypto PortfoliosFinal Thoughts Crypto is volatile by nature — but your portfolio doesn’t have to be chaotic. Volatility-adjusted allocation doesn’t try to predict markets.It doesn’t chase narratives.It simply controls risk intelligently. Jason didn’t become rich overnight using this method — but he stayed in the game, avoided emotional blowups, and positioned himself to compound over time. And in crypto, survival is the real edge. Explore more strategies: Txchyon Portfolio Management Hub

-

Nefu

Nefu - 25 Dec 2025

- Portfolio management

Volatility-Based Rebalancing Explained for Crypto Portfolios

What Is Volatility-Based Rebalancing? Volatility-based rebalancing is a strategy for adjusting portfolio weights based on the observed or expected volatility of each asset. Unlike traditional rebalancing methods, which may simply return your portfolio to fixed percentages (time-based) or react to drift thresholds, volatility-based rebalancing actively changes allocations to maintain consistent risk. Here’s the key principle: High-volatility assets → reduce allocation Low-volatility assets → increase allocationThe logic is simple: when an asset swings wildly, even a small percentage can dominate your portfolio’s total risk. Reducing its weight prevents large drawdowns during market turbulence. Conversely, allocating more to stable assets helps maintain a balanced risk profile without sacrificing overall exposure.Builds on: Crypto Portfolio Risk Management Explained (Protect Capital First)Why Volatility Matters More in Crypto Crypto markets are inherently volatile. Unlike traditional stocks or ETFs, price swings of 10–30% in a single day are common, particularly in smaller altcoins or meme coins. For example:Bitcoin might swing ±5–10% in a week Ethereum might swing ±10–20% Smaller altcoins can swing ±30–60%If your portfolio is allocated equally by capital rather than risk, these high-volatility assets can dominate exposure unintentionally. A 10% allocation to a small-cap coin that swings ±50% is far riskier than a 30% allocation to Bitcoin moving ±5%. Volatility-based rebalancing ensures your portfolio’s overall risk remains within tolerable limits, rather than being skewed by dramatic moves in a few assets.Step-by-Step Implementation of Volatility-Based Rebalancing Let’s break down the process, including practical steps and tools. 1. Measure Asset Volatility First, determine how volatile each asset is. Common methods include:Historical volatility: Standard deviation of daily returns over a given period (e.g., 30 days, 90 days) Expected volatility: Forecasts based on market conditions, implied by option prices or trend indicators Relative volatility: Comparing each asset’s swings relative to Bitcoin as a baselineTools to calculate volatility:Portfolio trackers: CoinStats, Delta, Zerion (automatic calculation) Spreadsheets: Google Sheets or Excel using historical price data Custom dashboards: Python or JavaScript for full control over formulas and time windowsRelated: How to Track Crypto Portfolio Performance2. Determine Target Portfolio Risk Before adjusting allocations, define how much total portfolio volatility you are comfortable with. For example:Conservative: 5–10% monthly swings Balanced: 10–20% monthly swings Aggressive: 20–40% monthly swingsYour risk tolerance guides how much allocation adjustment is necessary for volatile assets. A conservative investor would trim high-volatility altcoins more aggressively, while an aggressive investor might tolerate larger swings.See also: Volatility-Adjusted Allocation in Crypto for similar risk-based allocation principles.3. Adjust Allocations Inversely to Volatility Once you know each asset’s volatility and your target risk:Reduce exposure to the most volatile assets Increase exposure to the least volatile assetsExample: BTC (volatility 10%) → target 40% → no adjustment needed ETH (volatility 20%) → target 30% → reduce to 25% Altcoin XYZ (volatility 50%) → target 20% → reduce to 10% Stablecoin USDC (volatility 1%) → increase allocation to absorb riskThis ensures that each asset contributes proportionally to overall portfolio risk, rather than just capital allocation. Over time, your portfolio stays more stable during market swings, reducing the chance of forced selling during downturns.4. Rebalance Periodically Volatility is not static. As market conditions change:Assets that were calm may become volatile Assets that were risky may stabilizeRebalancing periodically (weekly, monthly, or quarterly) ensures allocations reflect current conditions. You can combine time-based schedules with threshold triggers:Hybrid method: Check monthly but rebalance only if volatility-adjusted weights have drifted more than ±5% from targets This prevents overtrading and reduces feesRelated: Time-Based vs Threshold Rebalancing for Crypto Portfolios5. Track Results and Refine After rebalancing, track the impact on performance and risk:Compare realized and unrealized gains across high and low-volatility assets Monitor drawdowns and portfolio standard deviation Adjust risk targets if your tolerance or market conditions changeThis closes the feedback loop: measurement informs adjustments, and adjustments inform future measurement.Reference: Step-by-Step Rebalancing GuideBenefits of Volatility-Based RebalancingStabilizes Portfolio RiskBy allocating according to volatility, you reduce the chance that a single asset dominates overall risk.Prevents Large DrawdownsVolatile assets are trimmed during boom periods, limiting exposure before a market reversal.Improves Emotional DisciplineKnowing allocations are data-driven reduces panic selling during dips.Supports Dynamic AllocationWorks well alongside factor-based strategies (momentum, size, value) and market-cap weighting.Adaptable Across PortfoliosWhether holding BTC/ETH only or 50+ altcoins, the principles scale.Case Study: Jason’s Crypto Portfolio Jason’s initial portfolio:BTC 40% ETH 30% Altcoins 30%After a month of volatility:BTC swings ±10% ETH swings ±20% Altcoins swing ±50%Resulting allocation (capital-based): BTC 35% ETH 25% Altcoins 40%If Jason used volatility-based rebalancing:BTC remains 40% (low volatility, stable) ETH reduced to 25% (medium volatility) Altcoins reduced to 15% (high volatility) Stablecoins increased to 20% (absorbs risk)Outcome:Drawdowns reduced from 40% to 20% Fewer forced panic sales Emotional stress decreased, allowing long-term strategy executionCommon Mistakes to AvoidIgnoring volatility changes: Old volatility data may misrepresent current risk. Over-rebalancing: Trading fees can erode returns; use thresholds. Failing to integrate risk tolerance: Aggressive investors may need different targets. Neglecting stablecoins: Low-volatility assets are essential for risk absorption. Confusing capital vs risk allocation: Equal capital allocation is not equal risk contribution.Volatility-Based Rebalancing vs Traditional MethodsFeature Time-Based Rebalancing Threshold Rebalancing Volatility-Based RebalancingBasis Fixed schedule % deviation from target Asset risk contributionAdvantage Simple, disciplined Trades only when needed Maintains stable portfolio riskDisadvantage May trade unnecessarily May miss gradual risk changes Requires volatility calculationsBest For Beginners, hands-off investors Experienced traders Risk-sensitive, data-driven investorsRelated reading: Market Cap Weighted Allocation ExplainedEmotional and Behavioral Benefits Volatility-based rebalancing isn’t just math — it protects your psychology:Reduces FOMO from fast-moving altcoins Keeps calm during large BTC corrections Builds confidence in rules-based investing Encourages consistency over speculationJason reported better sleep and less screen-checking after applying volatility-based rebalancing — the portfolio felt manageable even during intense market swings.Integrating Volatility-Based Rebalancing With Other StrategiesCombine with market-cap weighting to maintain exposure to major coins while managing risk from smaller assets. Integrate with factor-based strategies like momentum or value investing. Use in tandem with staking or lending positions, adjusting for risk of smart contracts. Link to performance tracking dashboards to monitor real-time risk contribution.Reference: Volatility-Adjusted Portfolio AllocationFinal Thoughts Volatility-based rebalancing is a data-driven, risk-focused approach to crypto portfolio management. It ensures that:Your portfolio stays aligned with your risk tolerance Emotional decisions are minimized Drawdowns are manageable Long-term strategy execution is easierCrypto is volatile by nature — but your portfolio doesn’t have to be chaotic. By adjusting allocations based on volatility, you control risk proactively rather than reactively. For investors looking to survive multiple market cycles, avoid panic selling, and grow consistently, volatility-based rebalancing is a powerful tool in the portfolio management toolkit. Explore more related strategies: Txchyon Portfolio Management Hub

-

Nefu

Nefu - 25 Dec 2025

- Getting started

How to Set Up Rabby Wallet: Step-by-Step Tutorial for Beginners

I first downloaded Rabby wallet when I was farming the hyperliquid launches. This is the go to wallet for hyperliquid ecosystem, plus it works perfectly fine with ethereum coins as well. Rabby Wallet has emerged as one of the top choices for Ethereum and EVM-compatible chain users in 2026. Developed by the DeBank team, it's a free, open-source browser extension wallet built specifically for DeFi power users while remaining accessible to beginners who want extra security and convenience. Rabby supports hundreds of EVM chains (Ethereum, Polygon, BNB Chain, Arbitrum, Optimism, Base, Avalanche, zkSync, and many more) with automatic chain switching, built-in transaction simulation, advanced security alerts, and a beautiful address book. It can even import and replace MetaMask seamlessly, making the switch effortless. As a non-custodial wallet, you fully control your private keys and recovery phrase. This guide will walk you through setting up Rabby from scratch, backing up securely, and preparing for safe DeFi interactions—helping you avoid the 10 Biggest Crypto Mistakes Beginners Make in 2026. Why Choose Rabby Wallet as a Beginner? Rabby stands out, especially for anyone planning to explore DeFi:Superior Security Features: Pre-transaction simulation shows exactly what will happen (balance changes, approvals) before you sign. Automatic Chain Switching: No manual network changes when visiting dApps on different chains. Better Than MetaMask in Many Ways: Smarter address handling (shows native balances across chains), gas suggestions, and risk detection. Seamless MetaMask Replacement: Imports your existing accounts and can override MetaMask on sites. Rich DeFi Integration: Powered by DeBank data—see your full portfolio, positions, and history in one place.For comparisons, check Best Crypto Wallets for Beginners in 2026: Top Picks and Reviews. Many users now prefer Rabby over How to Set Up MetaMask Wallet: Step-by-Step Tutorial for Beginners 2026 for daily EVM use. Prerequisites Before StartingA computer with Chrome, Brave, Edge, or Firefox browser (Rabby is browser-extension only—no mobile app yet). A secure, private environment to record your recovery phrase. Paper and pen for backup.Step-by-Step Guide to Setting Up Rabby Wallet Setup takes less than 5 minutes. Step 1: Download Rabby from Official Sources Always use the official site to avoid phishing extensions:Visit https://rabby.io and click Download. Or go directly to the Chrome Web Store: Search "Rabby Wallet" or use the link from the official site. Compatible browsers: Chrome, Brave, Edge, Firefox.Critical Warning: Only install from https://rabby.io or official store listings. Fake extensions can drain your funds instantly. Step 2: Install and Launch the ExtensionAdd Rabby to your browser. Pin it to your toolbar for easy access. Click the Rabby icon → You'll see options: Create New Wallet or Import Existing Wallet.Step 3: Create a New WalletSelect Create Wallet. Set a strong password (used to unlock the extension locally). Rabby generates a 12-word secret recovery phrase. Write down the words exactly in order on paper. Never screenshot or store digitally. Verify by re-entering the words.This seed phrase is your ultimate backup. Store it offline and never share it. For more on secure practices, see How to Transfer Crypto from Exchange to Wallet Safely in 2026. Step 4: Complete Setup and SecureConfirm password again. Optionally enable biometric unlock (if your browser supports it). Rabby encrypts everything locally—no data leaves your device.Step 5: Explore Your New WalletYour dashboard shows your address, total balance across chains, and recent activity. Rabby automatically adds popular EVM chains. Click Receive to copy your address (same across all EVM chains—Rabby handles the rest). View native balances on different networks without switching manually.Step 6: Fund Your Wallet (Optional Test) To confirm everything works:Buy ETH or stablecoins directly (via on-ramps in the extension). Or transfer from an exchange using your Rabby address.Beginners should start with How to Buy Ethereum for Beginners: Complete Step-by-Step Guide 2026 or How to Buy Crypto with Credit Card or PayPal in 2026. Test with a small amount first. Importing an Existing Wallet (Including from MetaMask) Switching from MetaMask or another wallet?Choose Import Wallet on startup. Enter your existing 12/24-word seed phrase or private key. Rabby imports all accounts and balances. Pro tip: Enable "Override MetaMask" in settings so sites automatically connect to Rabby instead.Advanced Features Beginners Will Love Once comfortable:Transaction Simulation: See exact outcomes before confirming—catches scams early. Gas Optimization: Suggests better gas prices and settings. Address Book: Save frequent contacts with names and notes. Portfolio Tracking: Detailed breakdown of holdings and DeFi positions. Hardware Wallet Support: Connect Ledger or Trezor for cold storage.These tools help with safer strategies like Dollar Cost Averaging Explained: The Best Strategy for Crypto Beginners in 2026. Common Issues and TroubleshootingdApp Not Connecting: Refresh page or re-connect wallet. Balance Not Showing on New Chain: Switch to that network manually once. Extension Conflicts: Disable MetaMask or set Rabby as default. Official support/docs: https://rabby.io/docsFinal Security Best PracticesNever enter your seed phrase on any website. Always check transaction simulations carefully. Use hardware wallets for large amounts. Stay calm during market hype—review Crypto Investing Psychology: Mastering Emotions and Avoiding FOMO as a Beginner in 2026.Rabby Wallet makes EVM DeFi safer and smoother than ever in 2026. Whether you're holding ETH, exploring Base chain apps, or managing positions across layers, Rabby gives you professional-grade tools with beginner-friendly design. Combine it with knowledge from Top 10 Cryptocurrencies Explained for Absolute Beginners in 2026 and Bitcoin vs Ethereum: Which is Better for Beginners in 2026. Welcome to smarter self-custody—enjoy the journey!

-

Nefu

Nefu - 24 Dec 2025

- Getting started

How to Buy Bitcoin for Beginners: Complete Step-by-Step Guide

Introduction: Buying Your First Bitcoin in 2026 Bitcoin remains the most popular entry point into cryptocurrency. Its established status, widespread recognition, and relative simplicity make it the top choice for newcomers searching "how to buy bitcoin for beginners" or "buy btc safely 2026." Buying Bitcoin today is easier and more regulated than ever, with numerous reputable platforms offering instant purchases via bank transfer, credit card, or digital wallets. However, the process still requires care to avoid fees, delays, or security risks. This complete step-by-step guide covers everything a beginner needs: choosing a platform, verification, funding, purchasing, and securing your Bitcoin. Follow these steps to make your first purchase confidently. Review core concepts in our what is cryptocurrency guide and key terms in our crypto terminology glossary. Avoid pitfalls outlined in our 10 biggest crypto mistakes.Step 1: Choose a Reputable Platform Your platform (exchange or broker) is the gateway to buying Bitcoin. Prioritize regulated, user-friendly options. Popular choices for beginners:Coinbase: Excellent interface, strong regulation. Binance: Wide features, competitive fees. Kraken: High security focus. Crypto.com: Rewards and debit card integration.Compare full details in our best crypto exchanges review. For instant purchases, see our guide on buying crypto with credit card or PayPal. Step 2: Create and Verify Your Account All legitimate platforms require identity verification (KYC) for fiat purchases.Visit the official website or download the official app. Sign up with email and create a strong password. Enable two-factor authentication immediately. Submit identity documents (passport, driver's license) and proof of address. Wait for approval — usually hours to a few days.Start with basic verification for lower limits; upgrade later for higher amounts. Step 3: Add a Payment Method Link your preferred funding source:Bank account (ACH/SEPA): Lowest fees, slower (3-5 days). Debit/Credit card: Instant but higher fees (2-4%). PayPal or Apple Pay: Convenient where supported.Platforms display fees upfront. Bank transfers are cheapest for larger purchases. Step 4: Deposit Funds Transfer money from your linked method.Bank transfers: Free or low-cost but take time. Card deposits: Instant but include processing fees.Start small for your first transaction to test the process.Step 5: Buy Bitcoin Once funds are available:Navigate to Buy/Sell or Trade section. Select Bitcoin (BTC). Enter amount in fiat currency or BTC quantity. Review total cost including fees. Confirm purchase.Bitcoin appears in your platform wallet instantly or within minutes. Pro Tip: Dollar-Cost Averaging Instead of one large buy, purchase fixed amounts weekly or monthly to average out volatility. Step 6: Secure Your Bitcoin Leaving Bitcoin on an exchange is convenient but risky. For safety, transfer to a personal wallet. Recommended options from our best crypto wallets guide:Software: Trust Wallet, Exodus. Hardware: Ledger or Trezor for larger amounts.Transfer steps:Copy your wallet's Bitcoin receive address. Initiate withdrawal from exchange. Pay network fee (varies by congestion). Wait for confirmation (usually 10-60 minutes).Always double-check addresses — Bitcoin transactions are irreversible. Fees to Expect When Buying BitcoinMethod Typical Fee Range SpeedBank Transfer 0-1.5% 3-5 daysDebit/Credit Card 2.5-4% InstantPayPal 3-4% InstantNetwork Withdrawal $1-20 (congestion-based) 10-60 minutesFees vary by platform and region — always check current rates. Common Questions Beginners Ask How much should I buy first? Start with an amount you can afford to lose, such as $50-500, to learn without stress. Is buying Bitcoin legal? Yes in most countries, with varying regulations. Check local laws. Do I need to pay taxes? Most jurisdictions require reporting capital gains. Track purchases and sales. What if the price drops after I buy? Volatility is normal. Focus on long-term holding and avoid emotional decisions — see our crypto psychology guide. Alternatives to Direct PurchaseBitcoin ETFs: Buy exposure through traditional brokerage (no wallet needed). Peer-to-peer platforms: Direct trades with others (higher risk). Bitcoin ATMs: Cash purchases (high fees).Direct exchange purchase remains simplest for beginners. Final Checklist Before BuyingPlatform is regulated and well-reviewed. 2FA enabled. Payment method verified. Starting with small amount. Personal wallet ready for transfer.Conclusion: Your First Bitcoin Is Just the Beginning Buying Bitcoin in 2026 is straightforward when following these steps. Prioritize security, understand fees, and start conservatively. Your purchase marks entry into a transformative asset class. Continue learning with our resources:Compare Bitcoin and Ethereum: Bitcoin vs Ethereum guide Explore other major coins: Top 10 cryptocurrencies explained Secure storage: Best crypto walletsStay patient, avoid hype, and build your position gradually. Welcome to Bitcoin — the foundation of cryptocurrency.

-

Nefu

Nefu - 24 Dec 2025

- Getting started

How to Set Up OKX Wallet: Step-by-Step Tutorial for Beginners

OKX Wallet is one of the most versatile non-custodial wallets available in 2026, ideal for beginners transitioning from centralized exchanges to full self-custody. It supports over 100 blockchains—including Bitcoin, Ethereum, Solana, BNB Chain, Polygon, Avalanche, and many more—allowing you to manage thousands of tokens, NFTs, and DeFi positions in one place. What makes OKX Wallet stand out is its all-in-one Web3 gateway: built-in DEX aggregator for best-price swaps, direct access to thousands of dApps, NFT marketplace integration, staking opportunities, and advanced risk detection for safer transactions. It's available as a mobile app (iOS and Android) and browser extension, with seamless cross-device sync. As a true self-custodial wallet, you alone control your private keys and seed phrase. This embodies the core crypto principle explained in What is Cryptocurrency? A Complete Beginner's Guide to Blockchain in 2026. In this tutorial, we'll guide you through creating a new OKX Wallet, securely backing up your recovery phrase, and preparing to receive or swap your first assets. We'll also cover importing existing wallets and essential security tips to steer clear of the 10 Biggest Crypto Mistakes Beginners Make in 2026. Why Choose OKX Wallet as a Beginner? Here's why OKX Wallet is increasingly popular among new users:Unmatched Multi-Chain Support: Over 100 networks in one wallet—no need for multiple apps. Built-in Web3 Tools: Swap across chains, browse dApps, manage NFTs, and earn yield without leaving the interface. Advanced Security Features: Transaction risk scanning, anti-phishing alerts, and optional hardware wallet integration. User-Friendly Interface: Clean dashboard with portfolio overview, ideal for tracking diverse holdings. No KYC Required for Wallet Use: Full privacy while maintaining self-custody.For comparisons with other options, see our roundup in Best Crypto Wallets for Beginners in 2026: Top Picks and Reviews. If you're focused on Ethereum dApps, compare with How to Set Up MetaMask Wallet: Step-by-Step Tutorial for Beginners 2026. Prerequisites Before StartingA smartphone (iOS/Android) or computer with Chrome browser. A private, distraction-free environment to note your recovery phrase. Paper and pen for backup—never store digitally initially.Step-by-Step Guide to Setting Up OKX Wallet The process is quick and straightforward, usually under 5 minutes. Step 1: Download OKX Wallet from Official Sources Download only from verified channels to avoid scams:Mobile App (Recommended for Beginners): iOS: App Store – Search "OKX: Buy Bitcoin, ETH & Crypto" or visit https://apps.apple.com/app/okx-buy-bitcoin-eth-crypto/id6444083989 (the wallet is integrated). Android: Google Play Store – Search "OKX" or use the official link.Browser Extension (Ideal for DeFi and dApps): Visit https://web3.okx.com/download or go directly to the Chrome Web Store and search "OKX Wallet".Critical Warning: Always verify you're on https://www.okx.com or https://web3.okx.com. Phishing sites mimic these exactly. Step 2: Install and Launch the WalletInstall the app or add the extension. Open OKX Wallet. You'll be greeted with options: Create Wallet or Import/Recover Wallet.Step 3: Create a New WalletSelect Create Wallet. Choose Seed Phrase Wallet (standard 12-word phrase) for full compatibility. The wallet generates your secret recovery phrase. Write down the 12 words in exact order on paper. Never screenshot or type into any device. Verify by re-entering the words to confirm.This phrase is your ultimate backup—if you lose access, it's the only way to recover funds. Store it offline and secure. Learn more about safe transfers in How to Transfer Crypto from Exchange to Wallet Safely in 2026. Step 4: Secure Your WalletSet a strong password or PIN. Enable biometrics (Face ID/Touch ID or fingerprint) for quick access. The wallet uses device-level encryption—no data leaves your phone/browser.Step 5: Explore the DashboardYour main screen shows total portfolio value and assets across chains. Switch networks easily via the chain selector. Tap Receive to get addresses for any supported chain (e.g., Ethereum for ETH, Bitcoin for BTC).OKX auto-manages addresses and supports custom token additions effortlessly. Step 6: Fund Your Wallet (Optional Test) To verify setup:Use the built-in Buy feature (via partners) for direct crypto purchases. Or transfer from an exchange using your OKX receive address.New to purchasing? Check How to Buy Bitcoin for Beginners: Complete Step-by-Step Guide 2026, How to Buy Ethereum for Beginners: Complete Step-by-Step Guide 2026, or How to Buy Crypto with Credit Card or PayPal in 2026. Start small to practice sending/receiving. Importing an Existing Wallet into OKX Switching from another wallet (e.g., MetaMask, Phantom, Trust Wallet, or Xverse)?Choose Import Wallet on startup. Enter your existing 12/24-word seed phrase. OKX detects compatible chains and imports balances, tokens, and NFTs automatically.This works seamlessly across EVM and non-EVM chains. Advanced Features to Explore as You Grow Once comfortable:DEX Aggregator: Swap assets cross-chain with best rates. Discover Tab: Browse dApps, DeFi protocols, and NFT marketplaces. Earn Section: Stake or lend for yields (similar to strategies in Dollar Cost Averaging Explained: The Best Strategy for Crypto Beginners in 2026). Risk Scanner: Automatic warnings for suspicious transactions. Hardware Support: Connect Ledger or other devices for enhanced security.Common TroubleshootingAssets Not Showing: Switch networks or add custom tokens manually. Sync Delays: Refresh or restart—NFTs/Ordinals may take time. Connection Issues: Ensure latest app/extension version. Official support: https://web3.okx.com/helpEssential Security Best PracticesNever share your seed phrase or password. Beware of fake apps/sites—always double-check URLs. Use transaction simulation/previews. Temper expectations and avoid impulsive moves—review Crypto Investing Psychology: Mastering Emotions and Avoiding FOMO as a Beginner in 2026.OKX Wallet empowers beginners to explore the full crypto ecosystem securely. Pair it with knowledge of top assets from Top 10 Cryptocurrencies Explained for Absolute Beginners in 2026 or debates like Bitcoin vs Ethereum: Which is Better for Beginners in 2026. Welcome to true on-chain freedom—start small and build confidently!

-

Nefu

Nefu - 23 Dec 2025

- Tools automation

Best Crypto Trading Bots: Automated, DCA, Grid, and Meme Coin Bots

Best Crypto Trading Bots in 2026 Crypto markets never sleep — but you do. Well I have a terrible sleep schedule I literally sleep 3 hours wake up to check the charts then fall asleep if the market is boring then wake up again to repeat this process unless the trenches is cooking. That’s why crypto trading bots have become one of the most important tools for traders. Whether you’re dollar-cost averaging into Bitcoin, running grid strategies on Ethereum, or sniping Solana meme coins at launch, trading bots allow you to trade faster, more consistently, and without emotion. This guide is the central hub for crypto trading bots on Txchyon. Every individual bot review and chain-specific guide will link back here. I will keep updating this article as new bots come available and I'll remove bots if they become decommissioned or if I find out they draining wallets or doing something retarded I'll remove them. In this article, you’ll learn:What crypto trading bots are and how they work The main types of trading bots (DCA, grid, arbitrage, Telegram bots) The best crypto trading bots in 2026 Which bots are best for beginners vs advanced traders How to use trading bots safely without blowing up your accountWhat Is a Crypto Trading Bot? A crypto trading bot is software that automatically executes trades on your behalf based on predefined rules or strategies. You might have to click a button or configure it but its makes trading much easier and faster then if you were to go to a dex, or cex to trade. Instead of manually:Watching charts all day Timing entries and exits Managing take-profit and stop-loss levelsA trading bot does this 24/7, exactly according to your settings. Most bots connect to centralized exchanges or decentralized exchanges using API keys, meaning they can trade but cannot withdraw funds, making them relatively safe when configured correctly.If you’re new to exchanges, start here:Best Crypto Exchanges for Beginners How to Buy Crypto SafelyWhy Use a Trading Bot Instead of Trading Manually? Most traders don’t lose money because they lack information — they lose because of emotions. Trading bots help eliminate:FOMO buying Panic selling Overtrading Revenge tradesThis connects directly with:Crypto Investing Psychology: Mastering Emotions and Avoiding FOMOBots excel because they:Execute rules consistently React instantly to market conditions Remove emotional bias Allow you to test strategies objectivelyThey don’t guarantee profits — but they dramatically improve discipline.Types of Crypto Trading Bots Explained Not all trading bots are the same. Here are the main categories you’ll see in 2026. 1. DCA (Dollar-Cost Averaging) Bots DCA bots automatically buy assets at regular intervals or during dips. Best for:Beginners Long-term investors Reducing volatility riskThese pair well with:Dollar Cost Averaging Explained for Beginners2. Grid Trading Bots Grid bots place buy and sell orders at predefined price intervals to profit from sideways markets. Best for:Ranging markets High-liquidity pairs Experienced tradersThey require careful setup but can generate consistent returns in the right conditions.3. Arbitrage Bots Arbitrage bots exploit price differences between exchanges. Best for:Advanced traders High-volume accounts Low-fee environmentsCompetition is fierce, and margins are thin, but automation is mandatory here.4. Telegram Trading Bots (Meme Coin Bots) Telegram bots dominate Solana meme coin trading in 2026. They allow you to:Buy tokens at launch Snipe liquidity events Auto-sell at profit targetsThese bots require a Solana wallet:How to Set Up Phantom Wallet How to Transfer Crypto from Exchange to Wallet SafelyWe’ll cover these in detail in a dedicated guide:Best Solana Trading Bots for Meme Coins (coming soon)Best Crypto Trading Bots in 2026 (Quick Comparison) Below are the top platforms used by traders today. Individual reviews will be published separately. 3Commas Best for: DCA bots, smart trading, beginnersSupports: Binance, Coinbase, Bybit, OKX Bitsgap Best for: Grid trading, arbitrageSupports: 25+ exchanges Cryptohopper Best for: Strategy marketplaces, automationSupports: Multiple exchanges Pionex Best for: Built-in free botsSupports: Exchange + bot combined Telegram Bots (Solana) Best for: Meme coin sniping, fast executionSupports: Solana DEXs like JupiterAre Crypto Trading Bots Safe? Trading bots are as safe as the user. To reduce risk:Use API keys with trading-only permissions Never share private keys Start with small capital Avoid “guaranteed profit” claimsAlso make sure your wallets are properly secured:Best Crypto Wallets for BeginnersWho Should Use Crypto Trading Bots? Trading bots are ideal if you:Trade frequently Want consistency Manage multiple assets Can’t watch charts all dayThey are not ideal if you:Expect guaranteed profits Refuse to learn basic risk management Trade emotionallyBots amplify discipline — not skill.How to Get Started With Crypto Trading Bots A simple path:Choose a reputable exchange Set up a secure wallet Start with a DCA or simple grid bot Scale only after proving profitabilityHelpful guides:How to Buy Bitcoin for Beginners How to Buy Ethereum for BeginnersWhat’s Next in This Pillar? This article is the foundation. Next guides will cover:Best Solana Trading Bots for Meme Coins Individual bot reviews Analytics platforms that power bot strategies Portfolio tracking and alert automationBookmark this page — it will continue to grow as the central hub for crypto trading automation on Txchyon.Trading bots won’t make you rich overnight.But used correctly, they can give you something far more valuable: consistency.